Unlocking the Secrets of W9: What You Need to Know Now!

In the complex world of taxation and financial reporting, the W-9 form stands as a critical document that many individuals and businesses encounter. Understanding this seemingly simple piece of paper can save you from potential headaches and legal complications.

The Basics of W-9: What Exactly Is It?

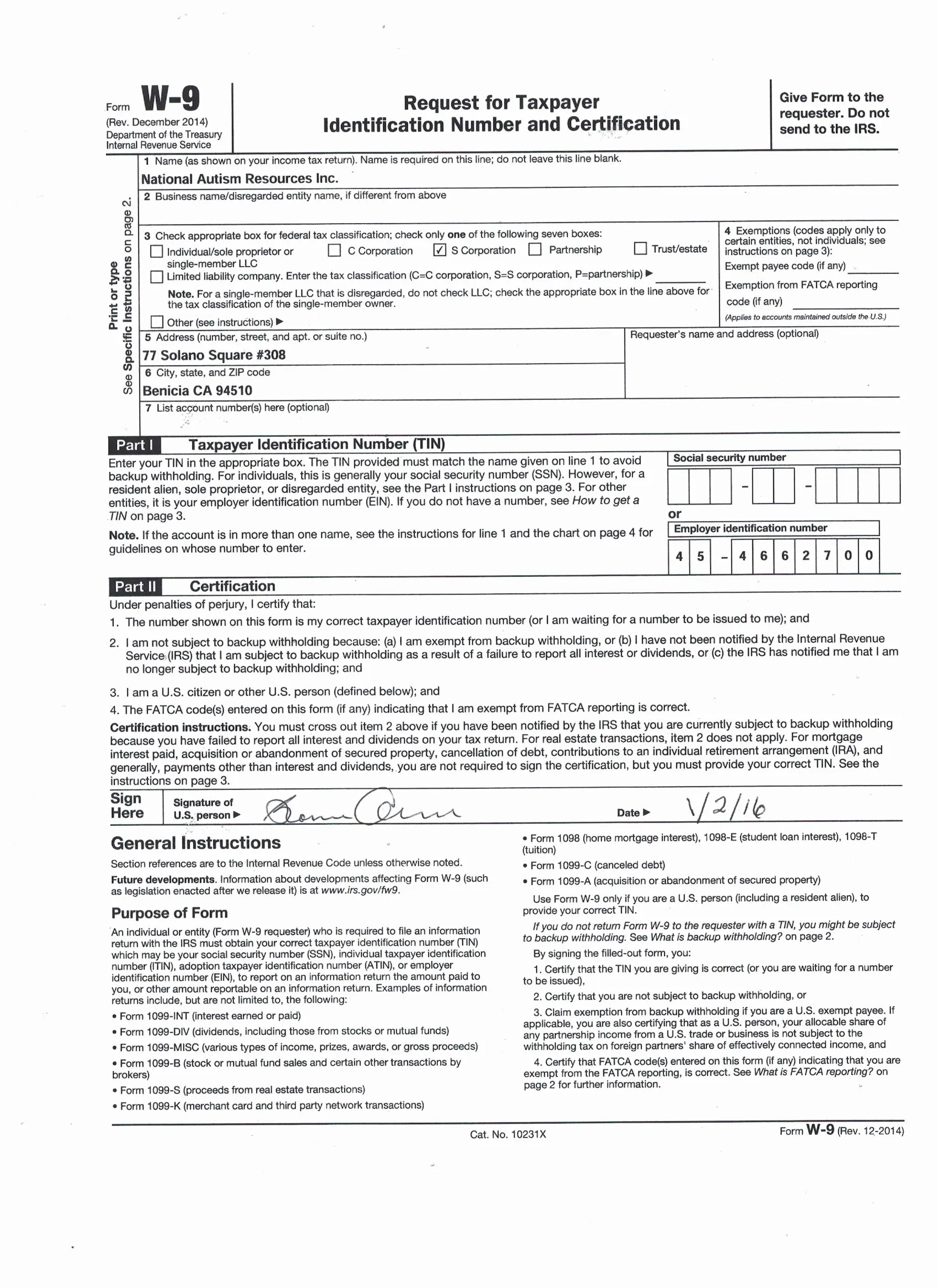

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is more than just another bureaucratic document. It serves as a crucial tool for income reporting and tax compliance. Essentially, this form collects essential information that helps the Internal Revenue Service (IRS) track income across various financial transactions.

Who Needs to Use a W-9?

Several groups typically interact with the W-9 form:

- Freelancers and Independent Contractors

- Self-employed professionals

- Individuals receiving specific types of income

- Businesses requesting tax identification information

“The W-9 is like a financial passport that helps track your income accurately,” says tax expert Michael Rodriguez.

Why Is the W-9 So Important?

The primary purpose of the W-9 is to ensure precise income reporting. When you provide this form, you’re giving entities the necessary information to:

- Report payments to the IRS

- Prepare accurate tax documents

- Comply with federal tax regulations

Privacy and Sensitive Information

Caution is paramount when handling a W-9. The form contains sensitive personal information, including your:

- Full legal name

- Business name (if applicable)

- Taxpayer Identification Number (TIN)

- Address

Completing the W-9: A Step-by-Step Guide

Filling out a W-9 might seem daunting, but it’s relatively straightforward. Here are some key tips:

- Use your legal name exactly as it appears on your tax documents

- Provide your current mailing address

- Enter your correct TIN (Social Security Number or Employer Identification Number)

- Sign and date the form

Potential Consequences of Incorrect Information

Providing inaccurate information can lead to serious repercussions, including:

- Backup withholding (currently set at 24%)

- Potential IRS penalties

- Delays in payment processing

When and How Often Should You Update?

Experts recommend updating your W-9 whenever:

- Your legal name changes

- Your business structure shifts

- Your TIN is modified

- Your address is updated

“Maintaining current information is crucial for smooth financial transactions,” notes tax consultant Sarah Thompson.

Common Misconceptions

Many people misunderstand the W-9’s role. It is not a tax return but rather an informational document used for reporting purposes. The form itself is not submitted to the IRS but kept by the requesting entity.

Digital Age Considerations

With increasing digitalization, many organizations now request W-9 forms electronically. Always ensure you’re using secure, encrypted platforms when sharing such sensitive information.

Protecting Your Information

Best practices for W-9 security include:

- Verify the requester’s legitimacy

- Use secure transmission methods

- Be cautious of unsolicited requests

- Protect your physical and digital documents

Conclusion: Knowledge is Power

Understanding the W-9 form empowers you to navigate financial reporting with confidence. While it might seem complex, breaking it down into manageable steps makes the process much simpler.

Remember: When in doubt, consult a tax professional who can provide personalized guidance.

Disclaimer: This article provides general information and should not be considered definitive tax advice. Always consult with a qualified tax professional for specific guidance.

Leave a Comment