“`markdown

Unlock Your $1,400 Stimulus Check: What Every Taxpayer Needs to Know!

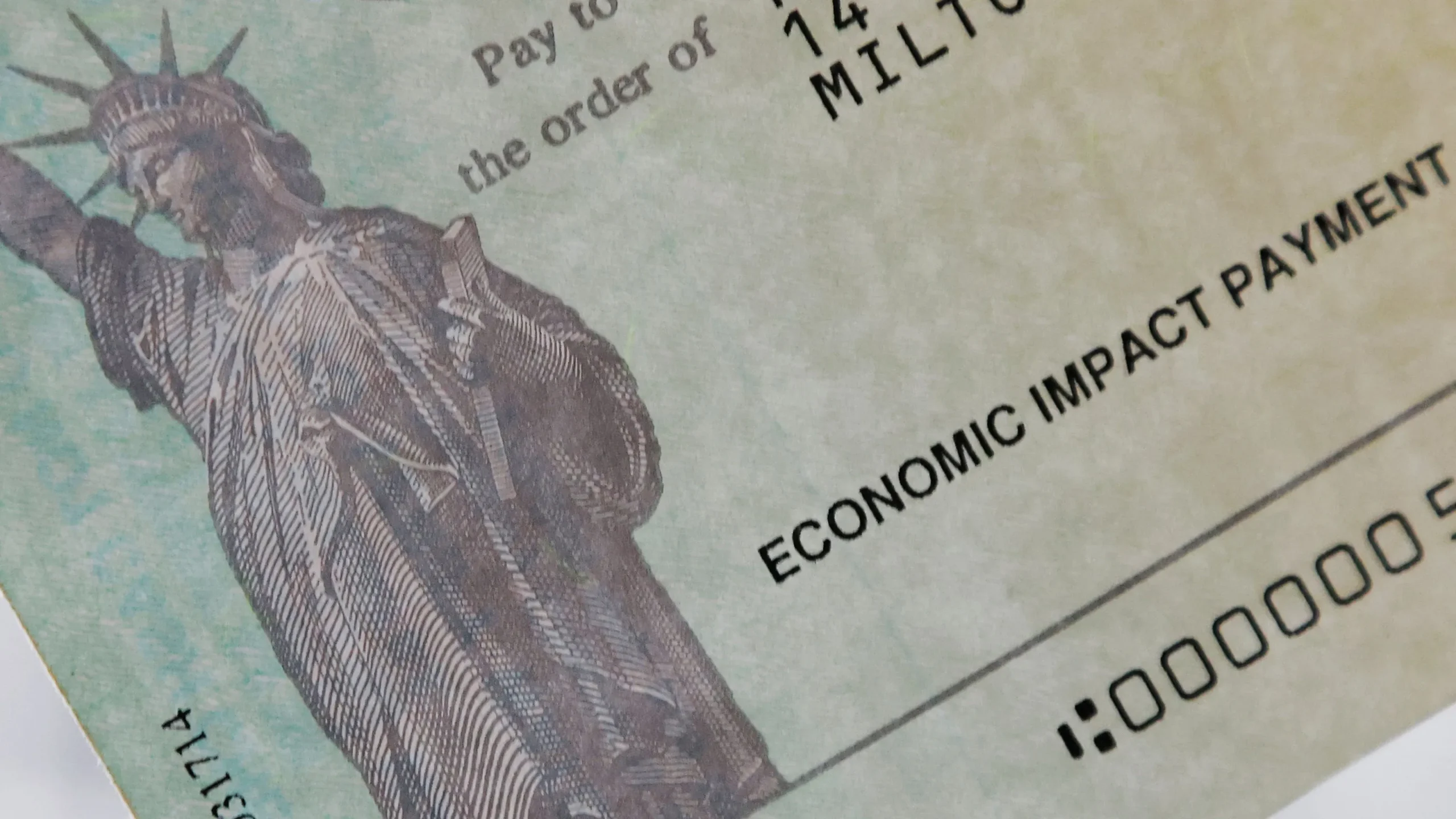

As we step into 2025, many taxpayers are eagerly anticipating a financial boost from the Internal Revenue Service (IRS). The agency has announced that it will be distributing $1,400 stimulus checks to eligible individuals through late January 2025. This initiative aims to support Americans who may not have claimed the Recovery Rebate Credit on their 2021 tax returns. With approximately 1 million Americans expected to receive these payments this month, it’s essential to understand the eligibility criteria and the process involved.

The IRS has made it clear that these payments are automatic; eligible individuals do not need to take any action to receive their checks. This means that if you qualify, your payment will be sent directly to you without any additional steps required. The checks will be distributed either through direct deposit or as mailed checks, depending on how taxpayers filed their 2021 tax returns.

Who is Eligible for the $1,400 Stimulus Check?

Eligibility for the stimulus check is based on the 2021 tax return filings. Taxpayers who did not claim the Recovery Rebate Credit are the primary candidates for this payment. To determine eligibility, individuals should check their 2021 tax return to see if they left the Recovery Rebate Credit field blank or reported it as $0.

- Income Thresholds: Eligibility may also depend on income levels and family size, which are critical factors in determining the amount of the stimulus check.

- Dependents: The maximum amount for the stimulus check is $1,400 per individual, with potential additional amounts for qualifying dependents.

How Will Taxpayers Receive Their Checks?

Eligible taxpayers will receive their checks automatically. The IRS began sending out payments in December 2024, and this process will continue through late January 2025. Each eligible taxpayer will receive a letter notifying them of their special payment, ensuring transparency in the distribution process.

- Direct Deposit or Mailed Checks: Payments will be issued based on the filing method used by the taxpayer. Those who opted for direct deposit will receive their funds electronically, while others will receive paper checks in the mail.

What If You Didn’t File a 2021 Tax Return?

For those who did not file a 2021 tax return, there is still a path to receiving the stimulus check. Taxpayers can file their return and claim the Recovery Rebate Credit before the April 15, 2025 deadline. This is a crucial opportunity for non-filers to ensure they do not miss out on the financial assistance available to them.

Importance of Understanding Tax Credits

Understanding tax credits and deductions can significantly benefit taxpayers. By familiarizing themselves with available credits, individuals can maximize their financial benefits. The IRS encourages all taxpayers, especially non-filers, to claim their credits before the upcoming deadline.

- IRS Resources: The IRS has provided various resources and FAQs on their website to help taxpayers navigate the process of claiming their stimulus checks and understanding their eligibility.

Historical Context of Stimulus Payments

This latest round of stimulus checks is part of a broader effort to support Americans during challenging economic times. The three rounds of COVID stimulus payments have totaled $814 billion, with the first payment of $1,200 issued in March 2020, followed by a second round of $600 in December 2020, and the third round of $1,400 in March 2021.

- Past Payments: These payments have been crucial in providing financial relief to millions of Americans, helping them navigate the economic impacts of the pandemic.

Conclusion

The distribution of the $1,400 stimulus checks represents a significant step in ensuring that all eligible Americans receive the financial assistance they are entitled to. As the IRS continues to process these payments, it is vital for taxpayers to verify their bank account information on file to ensure timely receipt of their funds.

Moreover, the IRS emphasizes the importance of filing accurate tax returns to avoid missing out on potential credits and payments in the future. By staying informed and proactive, taxpayers can make the most of the financial opportunities available to them in 2025.

For more information, taxpayers can visit the IRS website or consult the resources provided to ensure they are fully informed about their eligibility and the steps necessary to receive their payments.

Sources:

– IRS distributes $1,400 stimulus checks through late January 2025

– Who qualifies for $1400 stimulus checks? Here’s what to know

– [IRS

Leave a Comment