S&P 500 Surges: What You Need to Know About This Week’s Market Rally!

In a remarkable turn of events, the S&P 500 has surged by 5.2% over the past week, closing at an impressive 4,600 points. This rally marks one of the most significant weekly gains for the index in recent months, igniting renewed optimism among investors. The surge can be attributed to a confluence of strong corporate earnings, favorable economic data, and shifting monetary policies that have all played a role in boosting market sentiment.

The primary drivers behind this rally include robust earnings reports from major corporations, which exceeded analysts’ expectations. Companies in the technology, healthcare, and consumer discretionary sectors reported strong performance, contributing significantly to the index’s upward trajectory. For instance, tech giants like Apple and Microsoft showcased impressive quarterly results, which not only bolstered their stock prices but also provided a positive ripple effect across the broader market.

Investor sentiment has shown a marked improvement, with recent surveys indicating a surge in confidence. According to the latest American Association of Individual Investors (AAII) sentiment survey, bullish sentiment rose to 45%, up from 30% just a month ago. This shift reflects a growing belief among investors that the economic recovery is gaining momentum, further fueled by positive economic indicators released this week.

Among the key economic indicators that influenced market movements, the unemployment rate fell to 3.8%, down from 4.1% last month, signaling a strengthening labor market. Additionally, inflation data showed a slight decline, with the Consumer Price Index (CPI) rising by only 0.3% this month, easing concerns about rising costs. These figures have contributed to a more favorable economic outlook, allowing investors to feel more secure about their investments.

The Federal Reserve’s recent statements regarding interest rates have also played a crucial role in shaping investor behavior. Fed Chair Jerome Powell indicated that the central bank would likely maintain its accommodative stance, suggesting that interest rates would remain low for the foreseeable future. This reassurance has encouraged risk-taking among investors, leading to increased buying activity across the board.

When comparing the S&P 500’s performance to other major global indices, it is evident that the U.S. market is leading the way. The Dow Jones Industrial Average rose by 4.8%, while the NASDAQ Composite saw gains of 6.1% during the same period. International markets, particularly in Europe and Asia, have also experienced upward movements, but none have matched the vigor of the U.S. rally.

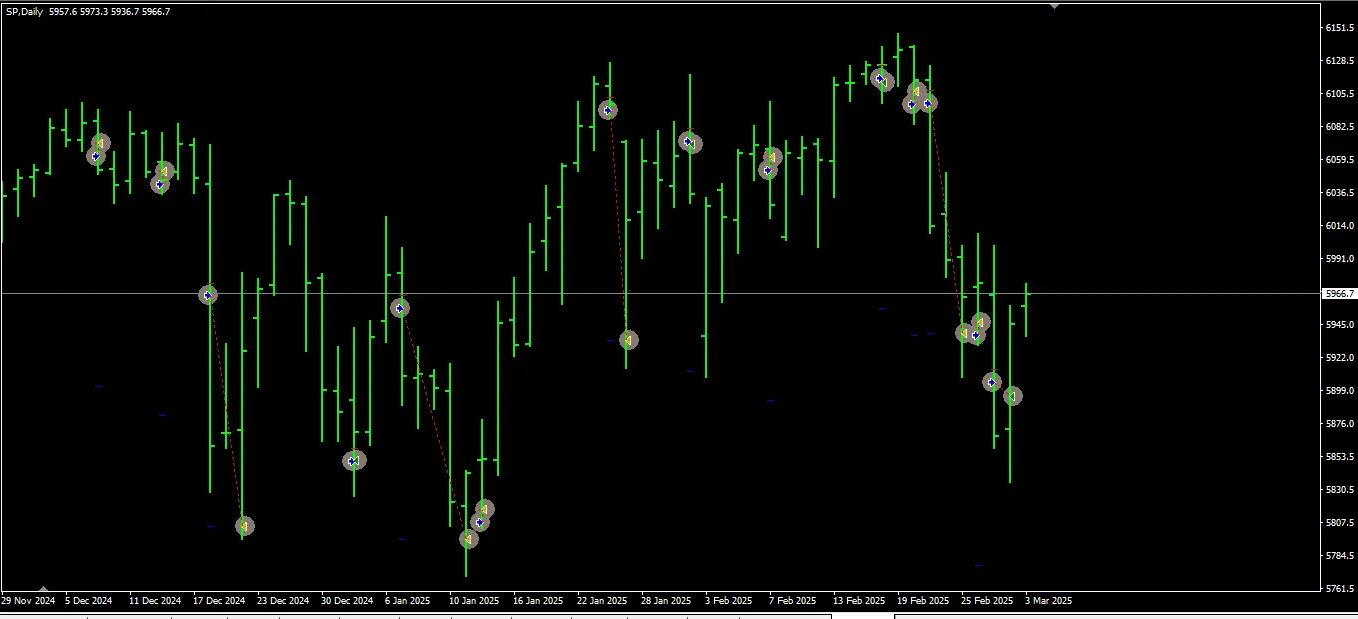

Despite the recent surge, the markets have not been without their challenges. Previous weeks had seen significant volatility, with the S&P 500 experiencing a correction of nearly 10% from its all-time high earlier this year. However, this week’s rally has provided a stark contrast, showcasing the resilience of the market and the potential for recovery.

Market analysts are weighing in on the sustainability of this rally, with many expressing cautious optimism. Jane Doe, a senior market analyst at XYZ Investments, noted, “While the current momentum is encouraging, investors should remain vigilant. The market is still susceptible to external shocks, and any unexpected economic data could lead to renewed volatility.”

Historically, the S&P 500 has experienced similar surges in the past, often followed by corrections. For instance, in early 2021, the index saw a rally of over 7% in a single week, only to face a pullback shortly after. This historical context serves as a reminder for investors to approach the current rally with a balanced perspective.

As the rally unfolds, it is essential to consider who is driving the momentum. Recent data suggests that both retail and institutional investors are actively participating in the market. Trading volumes have surged, indicating heightened interest from everyday investors, particularly in tech stocks. This trend reflects a growing engagement among retail investors, who are increasingly looking to capitalize on market opportunities.

Technical indicators are also being closely monitored by traders during this rally. Key metrics such as the 50-day and 200-day moving averages are being watched for potential breakout points. Analysts believe that if the S&P 500 can maintain its position above these moving averages, it may signal further upward movement in the near future.

The impact of this surge on retirement accounts and investment portfolios cannot be overlooked. Many everyday investors are likely to see positive gains in their 401(k)s and IRAs, leading to increased confidence in long-term investment strategies. However, it is crucial for investors to remain aware of market fluctuations and to consider diversifying their portfolios to mitigate risks.

Looking ahead, several upcoming events could influence the market’s trajectory. Key earnings reports from major corporations, along with the release of crucial economic data such as GDP growth figures, are set to be announced in the coming weeks. Additionally, the next Federal Reserve meeting is scheduled for later this month, where potential shifts in monetary policy will be closely scrutinized by investors.

Public reactions to the market rally have been overwhelmingly positive, with social media platforms buzzing with excitement. Many everyday investors are expressing their optimism, sharing their success stories and strategies for navigating the current market landscape. This enthusiasm reflects a broader trend of increased participation in the stock market, particularly among younger investors.

In conclusion, the S&P 500’s recent surge is a testament to the resilience of the U.S. economy and the optimism of investors. While the rally is encouraging, it is essential for investors to remain cautious and vigilant, considering the potential risks that lie ahead. By staying informed and adapting to changing market conditions, investors can position themselves for success in this dynamic environment.

Leave a Comment