“`markdown

Riot Platforms Stock Soars: What Investors Need to Know Now!

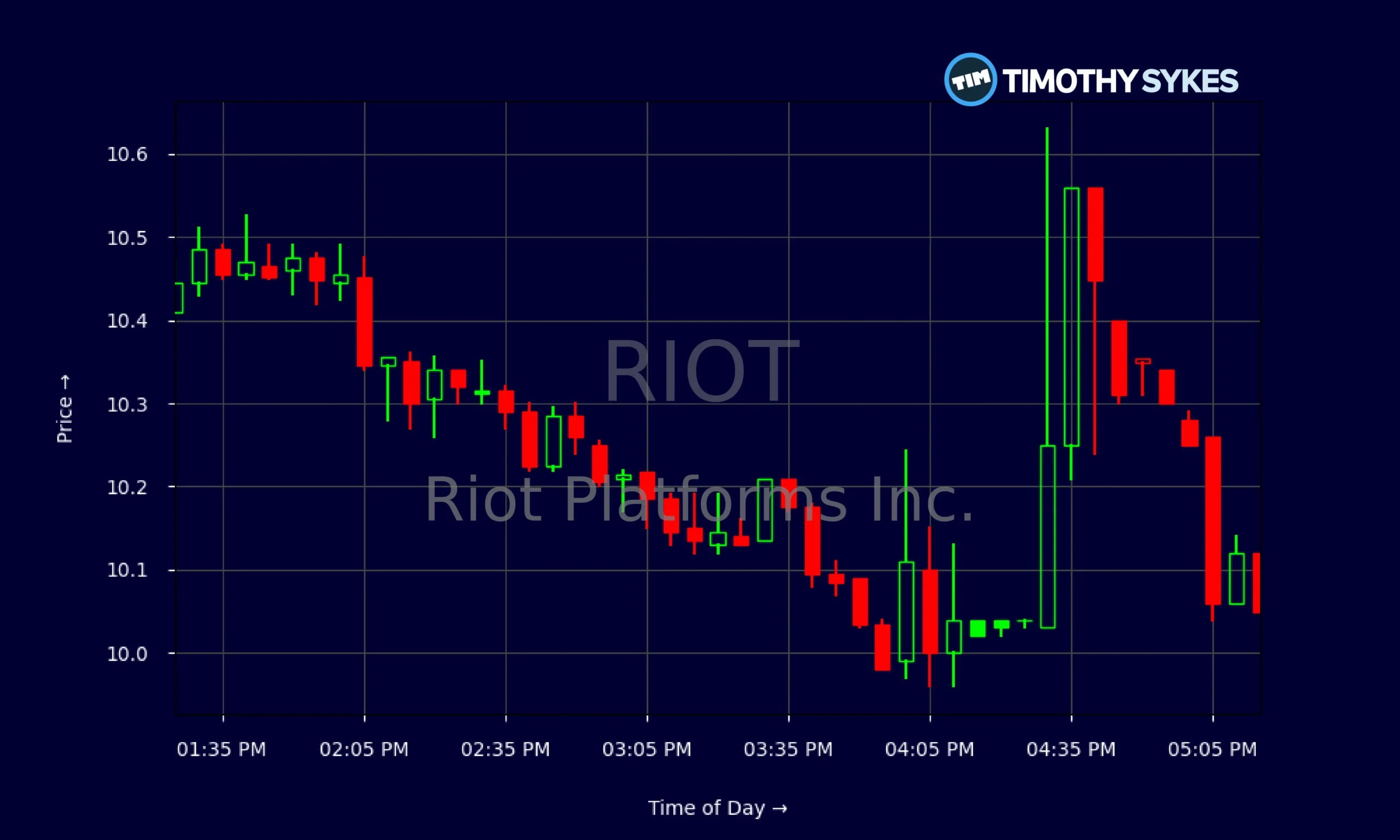

Riot Platforms, Inc. (NASDAQ: RIOT) has recently captured the attention of investors as its stock has surged by approximately 9.9% over the past month. This impressive performance stands in stark contrast to the S&P 500, which only gained 1.2% during the same period. The surge in Riot’s stock price has sparked discussions about the underlying factors driving this growth and what it means for current and prospective investors.

At the heart of this rally is the positive sentiment surrounding Bitcoin, which has seen a resurgence in its price. As a major player in the cryptocurrency mining sector, Riot Platforms benefits directly from the fluctuations in Bitcoin’s value. The company has been actively expanding its mining capacity, a strategic move expected to enhance its revenue potential in the coming quarters. According to market analysts, Riot’s aggressive expansion into new markets is also contributing to its stock’s upward trajectory.

However, it’s essential to note that Riot Platforms is projected to report a loss of $0.27 per share for the current quarter. This figure represents a staggering 156.3% year-over-year decline, raising questions about the company’s long-term profitability. Despite these losses, investor interest remains high, as evidenced by the trading of over 177,000 options contracts recently. This surge in trading activity indicates a robust demand for Riot’s stock, as investors speculate on its future performance.

Adding to the intrigue is a recent research report that has praised the cryptocurrency mining sector as a whole. Analysts have highlighted Riot Platforms as one of the best high-volume stocks to consider, reflecting strong market interest. However, potential investors should remain cautious, as there are concerns about possible dilution. Riot is asking shareholders to double the float of shares outstanding to raise funds, which could impact the stock’s value in the future.

The discussions surrounding Riot Platforms also delve into whether the recent stock performance signifies genuine growth or if it is merely a speculative bubble. The cryptocurrency market overall has shown signs of recovery, with Bitcoin prices climbing, which often correlates with Riot’s stock movements. This correlation has led to heightened optimism among investors, but it also brings with it a degree of risk.

Moreover, Riot Platforms has been making strides in sustainability by investing in renewable energy solutions for its mining operations. This move aligns with the growing environmental concerns among investors and could enhance the company’s reputation in an industry often criticized for its energy consumption. As investors become increasingly conscious of environmental, social, and governance (ESG) factors, Riot’s commitment to sustainable practices may prove beneficial in the long run.

Social media sentiment around Riot Platforms has also been largely positive, with discussions on platforms like Twitter and Reddit amplifying its visibility. This increased attention can drive further interest and trading volume, potentially influencing the stock’s performance. However, investors should be wary of the volatility that often accompanies stocks in the cryptocurrency sector.

Looking ahead, upcoming earnings reports and guidance from Riot Platforms will be critical in shaping investor expectations. Analysts and investors alike are closely monitoring regulatory developments in the cryptocurrency space, as changes in regulations could significantly impact Riot’s operations and stock performance. As the company navigates these challenges, its ability to adapt and innovate will be key to maintaining investor confidence.

In conclusion, Riot Platforms, Inc. has emerged as a noteworthy player in the cryptocurrency mining sector, with its stock experiencing a significant uptick in recent weeks. While the positive sentiment surrounding Bitcoin and the company’s expansion efforts have fueled this growth, potential investors must weigh the risks associated with ongoing losses and dilution concerns. As the cryptocurrency market continues to evolve, Riot’s ability to sustain its momentum will depend on its strategic decisions and external market conditions. Investors should remain vigilant and informed as they navigate this dynamic landscape.

“`

Leave a Comment