Palantir Stock Soars: Is This the AI Investment You Can’t Afford to Miss?

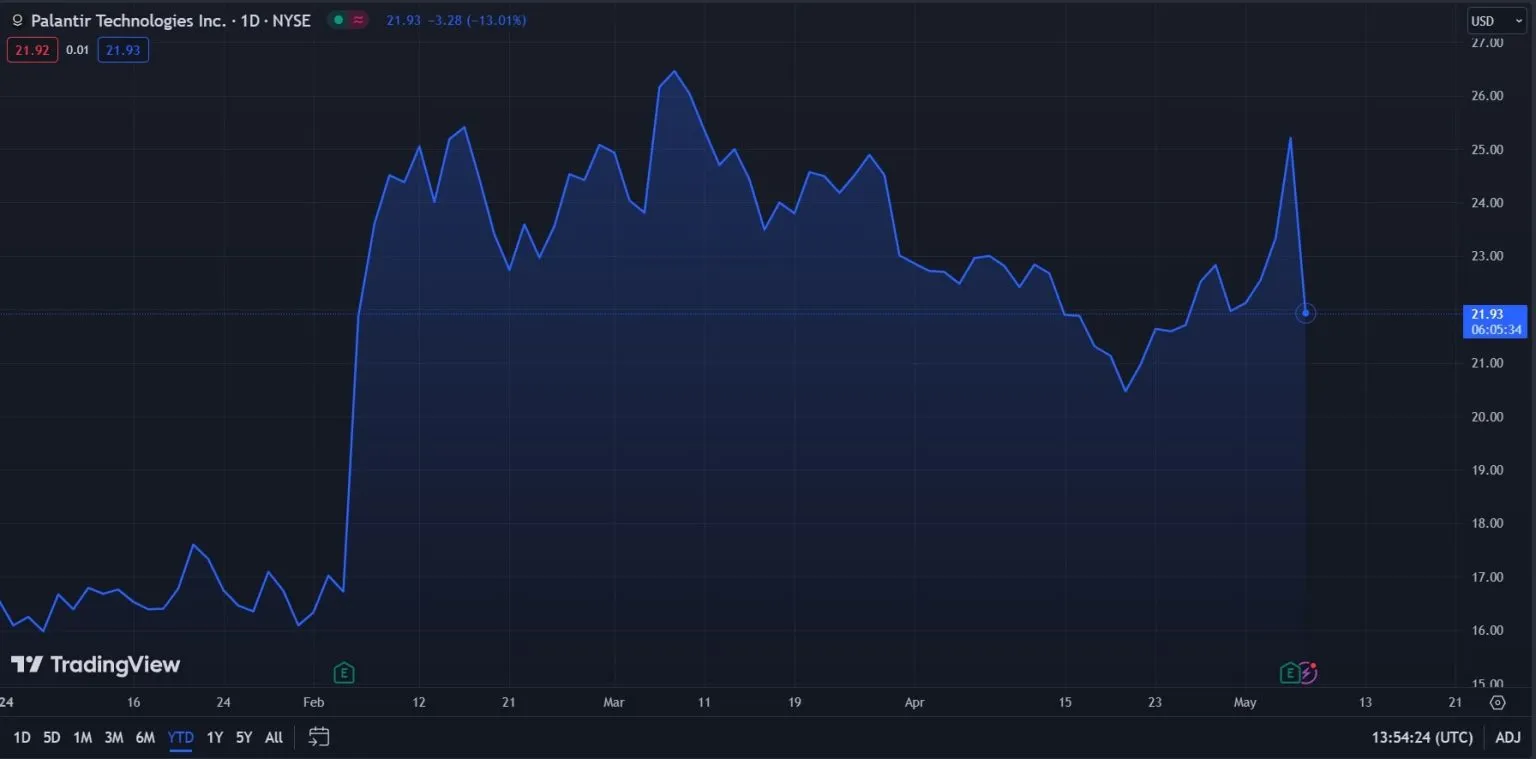

In the rapidly evolving world of artificial intelligence, Palantir Technologies (PLTR) has emerged as a standout performer, capturing the attention of investors and tech enthusiasts alike. The company’s stock has experienced a remarkable transformation in 2024, delivering an eye-popping surge that has left many wondering about its future potential.

The Extraordinary Rise

Palantir’s stock has defied expectations, skyrocketing by approximately 370% in 2024. To put this into perspective, an investor who placed just $100 in Palantir at the end of 2023 would now be sitting on a $470 investment – a return that many would consider nothing short of extraordinary.

What’s Driving the Surge?

The company’s success can be attributed to several key factors:

- Artificial Intelligence Platform (AIP)

- Expanding government and commercial contracts

- Strong revenue growth

- Strategic market positioning

“Palantir has transformed from a data analytics company to an AI powerhouse,” says financial analyst Mark Thompson.

Financial Performance Breaking Records

Palantir’s financial metrics tell a compelling story. The company reported:

– 30% year-over-year revenue growth

– Total revenue of $726 million

– 69% increase in U.S. commercial customer count

– Commercial segment revenue growth of 40% to $150 million

Government Sector Advantage

Interestingly, over 40% of Palantir’s revenue stems from government contracts. This provides a stable revenue stream and positions the company uniquely in the AI landscape.

The AI Platform Changing the Game

The Artificial Intelligence Platform (AIP) has been a game-changer for Palantir. It enables businesses to seamlessly integrate AI into their operations, offering sophisticated solutions that set the company apart from competitors.

Competitive Landscape

While Palantir shines brightly, it’s not without competition. Companies like SoundHound AI are also making significant strides in the AI market. However, Palantir’s long-standing presence since 2003 gives it a considerable advantage.

Valuation and Investment Considerations

Investors should approach with cautious optimism. The stock’s current metrics are noteworthy:

– Price-to-earnings (P/E) ratio: 411

– Price-to-sales (P/S) ratio: 24

These figures suggest the stock is priced at a premium, reflecting high market expectations.

Potential Risks

Important considerations for potential investors include:

1. High valuation could lead to volatility

2. Potential for significant sell-offs if quarterly earnings disappoint

3. Competitive pressures in the AI market

Future Outlook

Analysts remain cautiously optimistic about Palantir’s prospects. The continued growth in AI demand, coupled with the company’s strategic partnerships and innovative platform, suggests significant potential for future expansion.

Expert Perspective

“If Palantir can successfully leverage its AIP in government sectors,” notes tech investment strategist Sarah Chen, “its growth could be exponential.”

Conclusion

Palantir represents an intriguing investment opportunity in the AI landscape. While the stock’s performance has been impressive, potential investors should conduct thorough research and consider their individual financial goals.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.

Invest wisely, and stay informed.

Leave a Comment