Mortgage Rates Soar: What Homebuyers Need to Know Now!

In a dramatic shift for the housing market, mortgage rates have climbed to unprecedented heights, sending shockwaves through the real estate landscape. Potential homebuyers are facing a challenging environment that demands careful navigation and strategic planning.

The Current Mortgage Landscape

As of late November 2024, the average 30-year mortgage rate has reached approximately 6.84%, a significant jump from earlier in the year. This substantial increase is creating unprecedented challenges for both first-time homebuyers and those looking to upgrade their living situations.

Breaking Down the Numbers

The impact of these rising rates is profound:

1. Home Sales Decline: New home sales have dropped by 17.3% from September to October 2024.

2. Price Pressures: The S&P CoreLogic Case-Shiller U.S. National Home Price Index continues to reach record levels.

3. Buyer Hesitation: Many potential buyers are feeling the squeeze of higher borrowing costs.

Why Rates Are Climbing

Several key factors are driving the current mortgage rate environment:

- Federal Reserve Policies: Ongoing efforts to manage economic stability

- Treasury Note Yields: Closely tied to mortgage rate fluctuations

- Economic Uncertainty: Global economic conditions playing a significant role

“The current mortgage market is unlike anything we’ve seen in recent years,” says financial analyst Jennifer Roberts. “Buyers must be more strategic than ever.”

The Supply and Demand Dilemma

An interesting paradox has emerged in the housing market. Many homeowners with low fixed-rate mortgages from previous years are reluctant to sell, creating a limited inventory that further complicates the buying landscape.

Strategies for Potential Homebuyers

For those navigating this challenging market, several strategies can help:

- Act Quickly: Don’t wait for perfect conditions

- Assess Financial Readiness: Carefully evaluate your long-term financial situation

- Consider Alternative Options: Explore different types of mortgages

- Regional Research: Understand local market variations

Regional Variations Matter

It’s crucial to note that housing market dynamics differ significantly across regions. What works in one market may not apply to another, making local research absolutely essential.

Looking to the Future

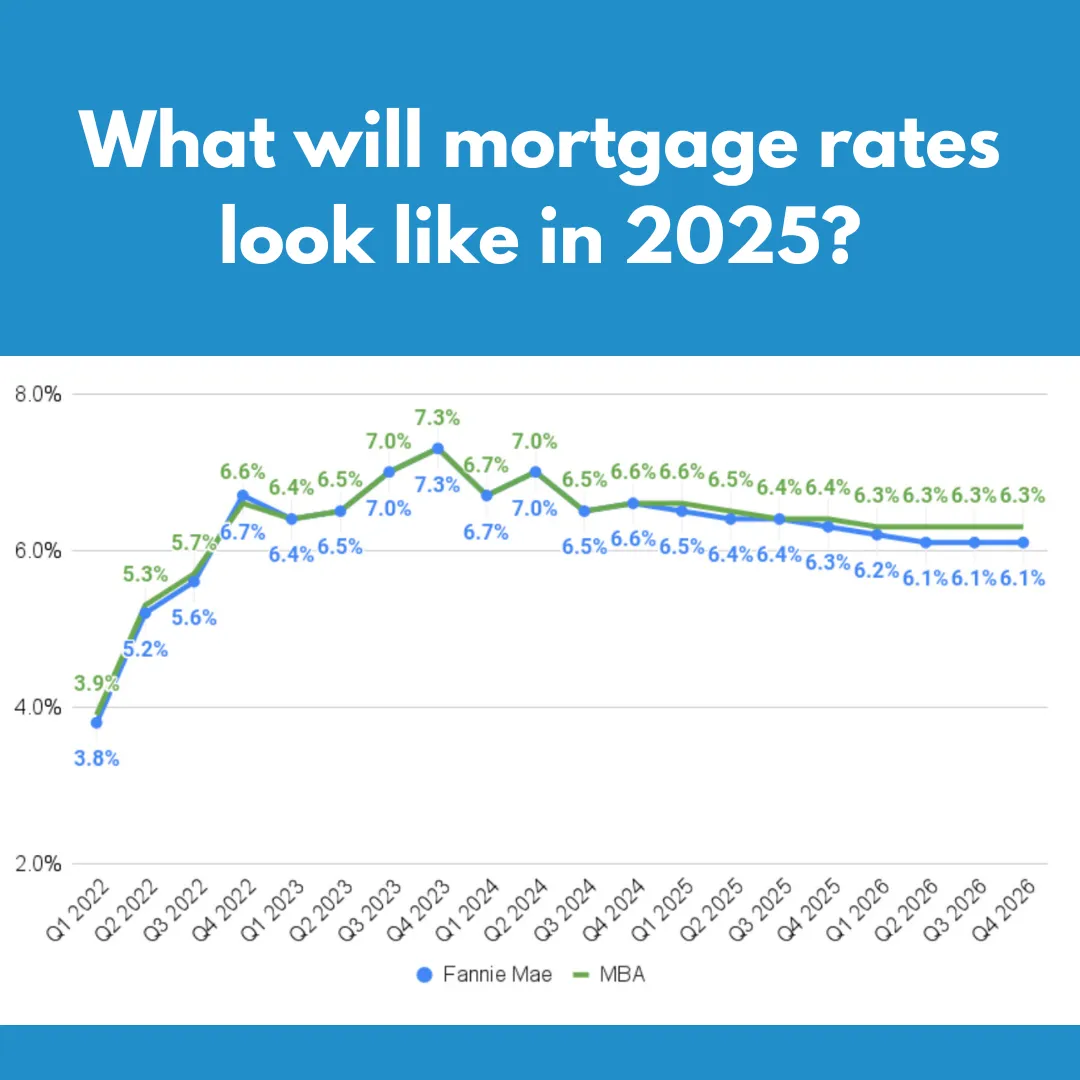

While the current environment seems challenging, there are glimmers of hope:

– Potential Federal Reserve rate cuts

– Possibility of increased new home construction

– Potential stabilization of market conditions

Expert Insights

Financial experts suggest that while rates are high, the long-term outlook isn’t entirely bleak. The market may see gradual adjustments that could benefit buyers in the coming months.

Key Takeaways for Homebuyers

Critical considerations for navigating the current mortgage landscape:

– Be prepared for higher monthly payments

– Maintain flexibility in your home-buying strategy

– Consider your long-term housing needs

– Don’t be discouraged by current rates

“The housing market is cyclical,” notes real estate expert Mark Thompson. “Today’s challenges are tomorrow’s opportunities.”

Conclusion

The current mortgage rate environment presents both challenges and opportunities. While rates have soared, informed and strategic buyers can still find their path to homeownership.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a financial professional before making significant financial decisions.

Stay informed, stay strategic, and don’t let rising rates derail your homeownership dreams.

Leave a Comment