MicroStrategy’s Bold Bitcoin Bet: Is MSTR Set to Soar or Crash?

In a bold move that has captured the attention of investors and analysts alike, MicroStrategy has significantly increased its Bitcoin holdings, positioning itself as a major player in the cryptocurrency market. With a current total of 279,420 BTC, valued at approximately $22.9 billion, the company’s aggressive strategy raises questions about its future trajectory. Is MicroStrategy set to soar, or are the risks too great for this ambitious venture?

Who is MicroStrategy?

MicroStrategy, a business intelligence firm, has become synonymous with Bitcoin investment under the leadership of its Executive Chairman, Michael Saylor. Saylor has been a vocal advocate for Bitcoin, promoting it as a hedge against inflation and a long-term store of value. His vision has transformed MicroStrategy into the largest institutional holder of Bitcoin, influencing other corporations to consider cryptocurrency as part of their asset portfolios.

What is the current state of MicroStrategy’s Bitcoin holdings?

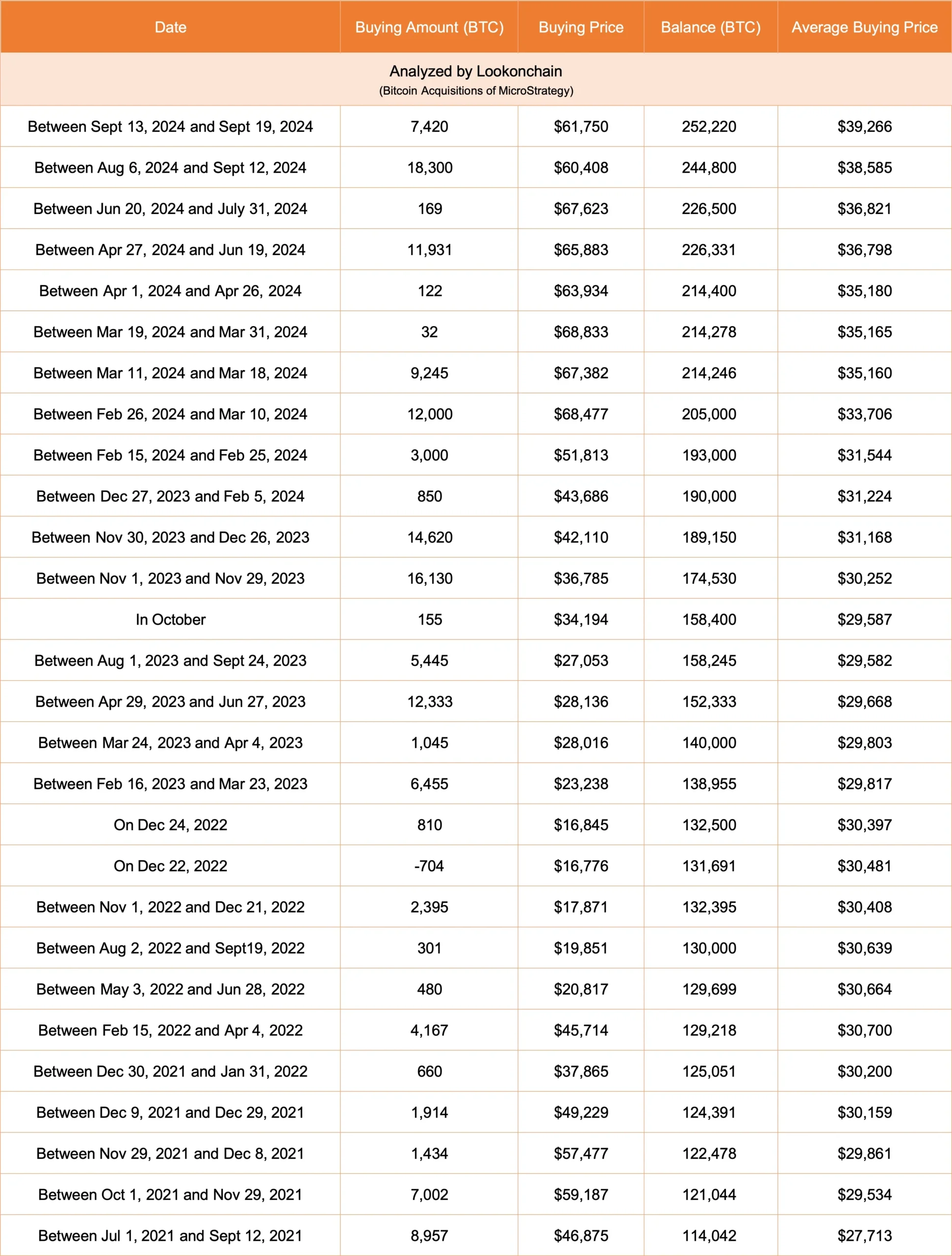

Recently, MicroStrategy made headlines by purchasing an additional 27,200 BTC for about $2 billion. This latest acquisition has contributed to the company’s impressive total of 279,420 BTC. The average purchase price for these coins stands at around $39,292, leading to a total investment of approximately $11.9 billion. Remarkably, these investments have generated over $11 billion in unrealized gains, reflecting a return on investment exceeding 100%.

When did this investment strategy begin?

MicroStrategy’s foray into Bitcoin began in August 2020, when it first announced its intention to invest in the cryptocurrency as a primary treasury reserve asset. Since then, the company has consistently increased its holdings, demonstrating a commitment to its strategic investment plan. This plan, dubbed the “21/21 plan,” aims to raise $42 billion over three years through equity and fixed-income securities to further bolster its Bitcoin reserves.

Where does MicroStrategy stand in the market?

MicroStrategy’s stock has experienced a remarkable surge, climbing nearly 330% in 2024 and reaching its highest level in 25 years. This impressive performance is largely attributed to the rising value of its Bitcoin assets, which have benefited from a broader market trend. The total cryptocurrency market cap has soared to approximately $2.8 trillion, fueled by Bitcoin’s recent all-time high of around $80,000. This surge has been driven by increased institutional interest and favorable regulatory developments following the recent U.S. elections.

Why is this significant?

MicroStrategy’s aggressive Bitcoin strategy has not only positioned it as a leader in the cryptocurrency space but has also sparked interest among other institutions. The company’s success may encourage global institutional adoption of Bitcoin, further legitimizing it as a reserve asset amid economic uncertainties. As more corporations consider cryptocurrency as part of their asset portfolios, MicroStrategy’s influence could reshape the landscape of corporate finance.

How does the regulatory environment impact MicroStrategy?

The recent U.S. elections have ushered in a wave of optimism regarding favorable regulations for cryptocurrencies. With pro-crypto candidates gaining power, the regulatory environment appears to be shifting in a direction that could benefit companies like MicroStrategy. This positive sentiment may further enhance the appeal of Bitcoin as a viable investment option for institutions.

Despite the impressive gains, it is essential to acknowledge the inherent volatility risks associated with cryptocurrency investments. The rapid fluctuations in Bitcoin’s price can pose significant challenges for MicroStrategy’s holdings in the future. Investors must remain cautious, as the same factors that drive Bitcoin’s price upward can also lead to sharp declines.

In conclusion, MicroStrategy’s bold bet on Bitcoin has positioned it at the forefront of the cryptocurrency revolution. With substantial holdings, impressive unrealized gains, and a strategic plan for future investments, the company is poised for potential growth. However, the volatility of the cryptocurrency market and the evolving regulatory landscape present challenges that could impact its trajectory. As MicroStrategy continues to navigate this dynamic environment, the question remains: will it soar to new heights, or will the risks prove too great? Only time will tell.

Leave a Comment