MARA Stock Surges: Is This the Next Big Player in Bitcoin Mining?

In a remarkable turn of events, shares of Marathon Digital Holdings, Inc. (MARA) surged by 12.1%, closing at $25.01 as Bitcoin prices soared past $85,000. This surge marks a staggering 54.6% increase in MARA’s stock value since the recent elections, igniting discussions about the company’s potential as a leading player in the Bitcoin mining sector. But what does this mean for investors and the future of cryptocurrency mining?

Who is MARA?

MARA is one of the largest Bitcoin miners globally, boasting an impressive installed hash rate of 36.9 EH/s. This positions the company as a significant player in the cryptocurrency mining landscape, attracting attention from both investors and analysts alike. As the demand for Bitcoin continues to rise, MARA’s operational capabilities and strategic decisions are under the spotlight.

What Drives MARA’s Profitability?

The profitability of MARA is closely tied to the price of Bitcoin. Currently, the company’s production cost stands at approximately $56,000 per Bitcoin. As Bitcoin’s price exceeds this threshold, MARA can sell its mined coins at higher margins, significantly enhancing its profitability. This relationship between production costs and market prices is crucial for investors to understand, as it directly impacts the company’s financial health.

Recent Operational Growth

In October 2024, MARA reported a 2% increase in Bitcoin production, yielding 717 BTC. Additionally, the company experienced a 14% growth in its energized hash rate, reaching 40.2 EH/s. These metrics reflect MARA’s commitment to operational efficiency and its ability to scale production in response to market demands. Such growth is essential for maintaining a competitive edge in the rapidly evolving cryptocurrency market.

Strategic Financial Moves

To further bolster its position, MARA recently secured a $200 million line of credit, collateralized by its Bitcoin holdings. This strategic financial maneuver allows the company to capitalize on emerging opportunities and cover corporate expenses. By leveraging its assets, MARA is positioning itself for sustained growth and resilience in a volatile market.

Diversification Beyond Bitcoin Mining

MARA is not solely focused on Bitcoin mining; the company is actively diversifying its operations. It has begun mining Kaspa and is developing innovative cooling technologies for data centers. This diversification strategy not only broadens MARA’s revenue streams but also mitigates risks associated with reliance on a single cryptocurrency. As the digital asset landscape evolves, such adaptability could prove invaluable.

Commitment to Environmental Sustainability

In an era where environmental concerns are paramount, MARA has taken significant steps to demonstrate its commitment to sustainability. The company has submitted disclosures to the Climate Disclosure Project, emphasizing its dedication to environmental transparency and sustainable practices in digital asset computing. This commitment not only enhances MARA’s reputation but also aligns with the growing demand for responsible corporate practices.

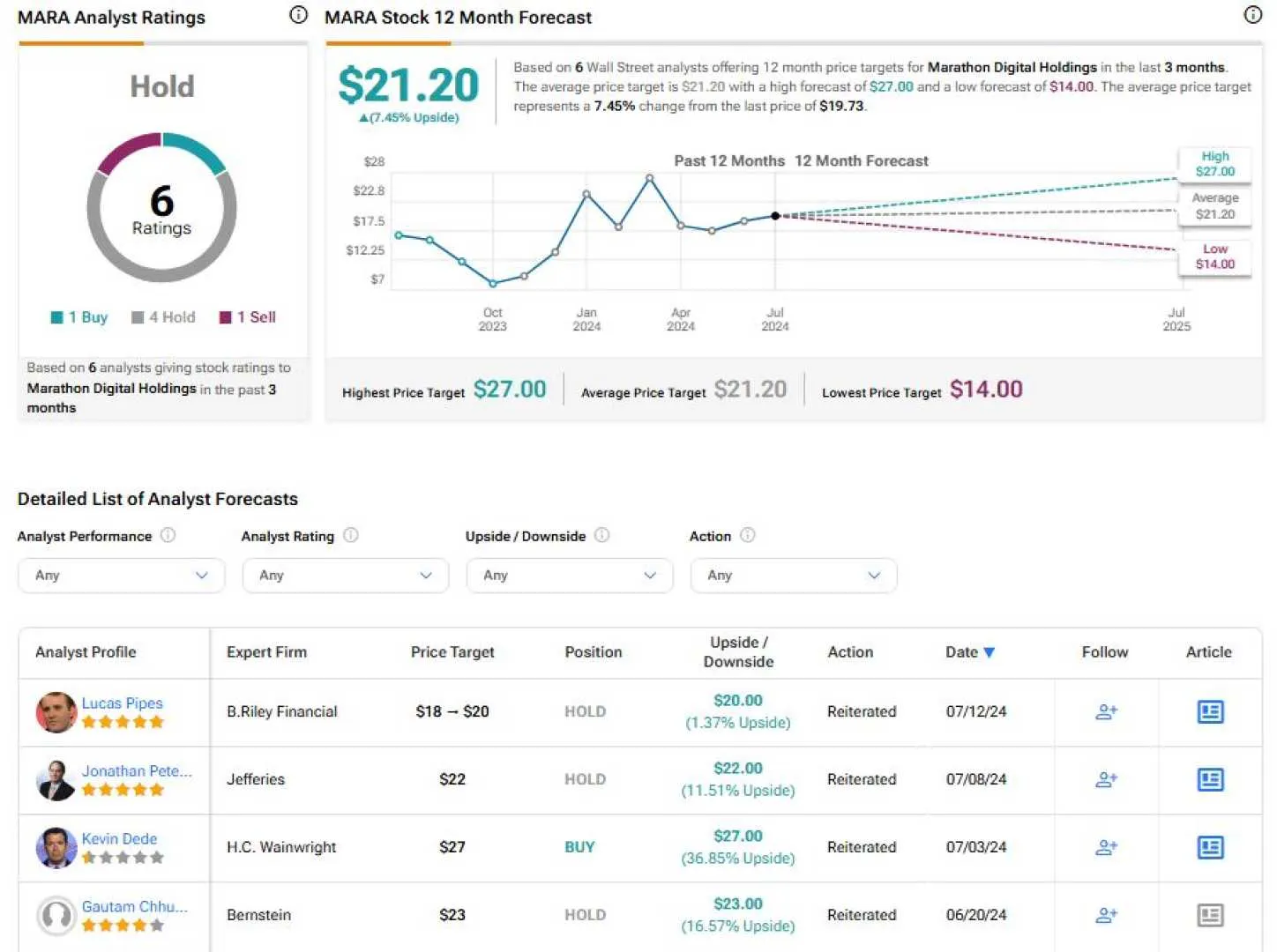

Analyst Ratings and Market Sentiment

Market sentiment surrounding MARA is largely positive, with the stock holding a consensus rating of “Moderate Buy” among analysts. Price targets suggest potential upside from current levels, with analysts from H.C. Wainwright reiterating a buy rating and setting a target of $27. This optimistic outlook reflects confidence in MARA’s operational capabilities and growth prospects.

Future Growth Prospects

Looking ahead, analysts predict that Bitcoin could reach as high as $200,000 by 2025. If these projections materialize, MARA’s stock performance could benefit significantly. The potential for increased Bitcoin prices presents a compelling opportunity for investors, making MARA a stock to watch in the coming years.

Strengthening Leadership

To navigate the complexities of the digital infrastructure technology sector, MARA has recently expanded its board of directors. These appointments aim to enhance oversight and strategic direction, ensuring that the company remains agile and responsive to market changes. Strong leadership will be crucial as MARA continues to evolve and adapt in a competitive landscape.

Conclusion

In summary, MARA’s recent stock surge and its position as a leading player in Bitcoin mining present a compelling narrative for investors. With operational growth, strategic financial moves, and a commitment to sustainability, the company is well-positioned for future success. As Bitcoin prices continue to fluctuate, MARA’s ability to adapt and innovate will be key to its long-term profitability. For those looking to invest in the cryptocurrency sector, MARA may just be the next big player to watch.

Leave a Comment