“`markdown

Interest Rates Drop Today: What It Means for Your Wallet!

By Jane Doe

In a significant move that could reshape the financial landscape for millions of Americans, the Federal Reserve announced a notable interest rate cut today. This decision, made during their latest meeting, aims to stimulate economic growth amidst concerns about a potential recession. Federal Reserve Chair Jerome Powell emphasized the need for this shift, stating, “Lowering rates is essential to support consumer spending and bolster business investment.”

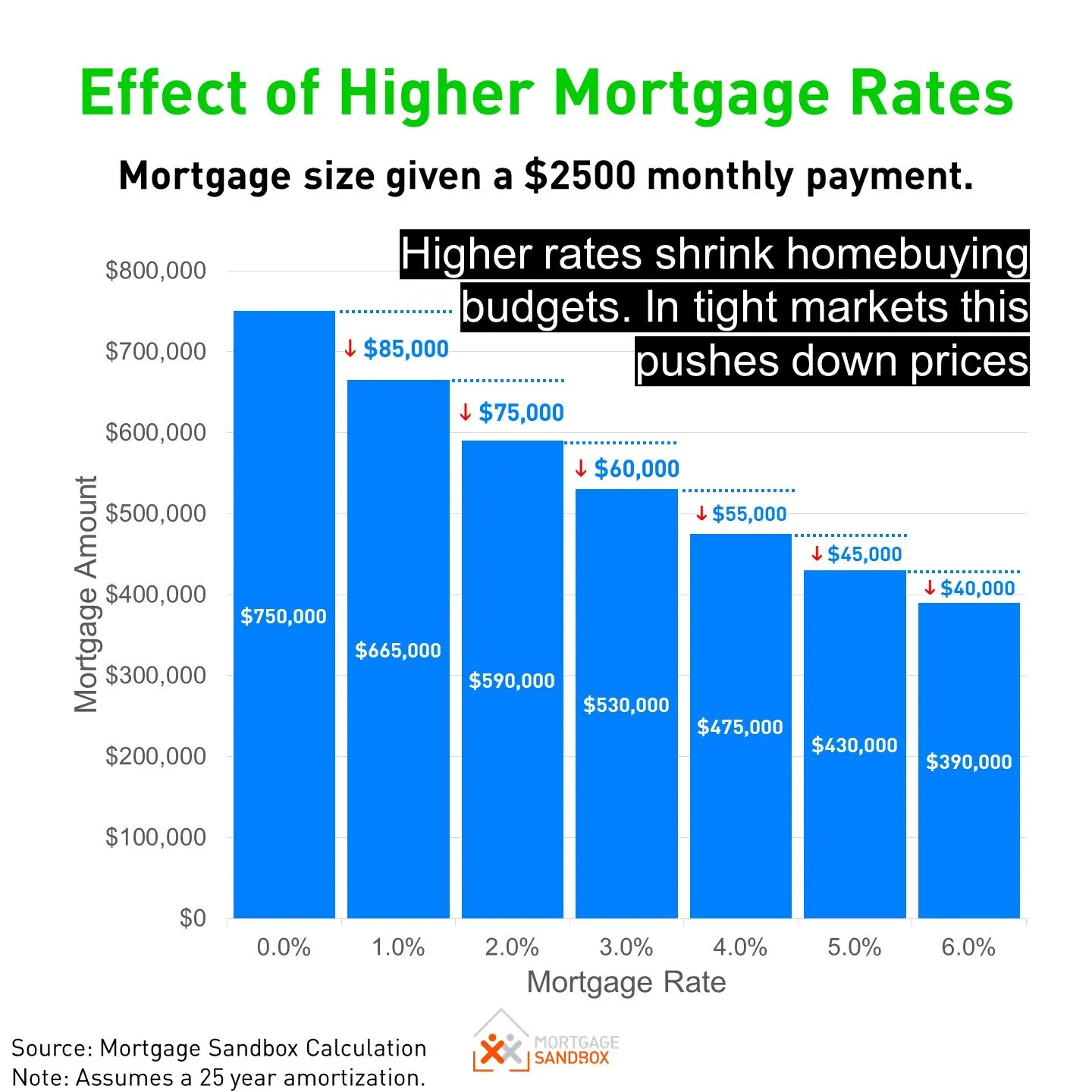

The Federal Reserve’s decision to cut rates is expected to lower borrowing costs for consumers across various sectors. Lower interest rates typically lead to reduced rates on mortgages, making home buying and refinancing more affordable. For many, this could mean the difference between owning a home and continuing to rent.

-

What does this mean for mortgages?

- Homebuyers can expect lower mortgage rates, which can significantly reduce monthly payments.

- Refinancing existing mortgages becomes more appealing, allowing homeowners to save money.

-

Impact on car loans and personal loans:

- With interest rates dropping, consumers may find lower rates on car loans, making it easier to finance new vehicles.

- Personal loans are also likely to become more affordable, encouraging individuals to consolidate debt or fund major purchases.

-

Credit card interest rates may decrease:

- Those carrying balances on credit cards could benefit from reduced interest rates, leading to lower monthly payments.

- This relief may help consumers manage their debt more effectively.

-

Consumer spending and economic stimulation:

- The rate cut is anticipated to stimulate consumer spending, as lower borrowing costs may encourage purchases and investments.

- Increased spending can lead to a boost in economic growth, which is crucial in the current climate.

-

Savings account interest rates:

- While borrowing costs decrease, savings account interest rates may also decline.

- This could impact individuals relying on interest income from their savings, necessitating a review of personal financial strategies.

The stock market reacted positively to the news of the rate cut, with analysts suggesting that lower interest rates can boost corporate profits and consumer spending. “The market often sees rate cuts as a sign of economic support,” noted financial analyst Sarah Green. “This can lead to increased investor confidence and a rally in stock prices.”

Homebuyers and investors are advised to act quickly to take advantage of the lower rates before they potentially rise again. Experts recommend reviewing personal finances, including debt management strategies, in light of the new interest rate environment. This proactive approach can help individuals make informed financial decisions.

As the Federal Reserve shifts its focus to support economic growth, businesses are likely to benefit from lower borrowing costs. This can lead to expansion and new hiring opportunities, further stimulating the economy. However, the long-term implications of the rate cut may include increased inflation if consumer spending rises significantly.

In conclusion, today’s interest rate cut by the Federal Reserve is a pivotal moment for consumers and the economy. With lower borrowing costs, individuals can expect relief across various financial products, from mortgages to credit cards. However, it is essential to stay informed about how these changes may affect personal finances and overall economic outlook. As always, consumers are encouraged to consult with financial advisors to navigate this evolving landscape effectively.

For more information on how interest rate cuts can impact your wallet, visit Darden School of Business and Investopedia.

“`

Leave a Comment