Intel (INTC) Stock Soars: What You Need to Know Now!

In a dramatic turn of events, Intel Corporation (NASDAQ: INTC) has become the center of attention in the semiconductor industry, with its stock experiencing a significant surge that has caught the eye of investors and market analysts alike. The technology giant’s shares jumped by an impressive 7.5% during the afternoon trading session, creating a buzz of excitement and speculation in the financial markets.

The Acquisition Speculation

Rumors of a potential acquisition have been the primary driver behind Intel’s recent stock performance. Sources suggest that the company has become an attractive takeover target, sending investors into a frenzy of anticipation. This speculation has breathed new life into a stock that has struggled considerably throughout the year, with shares down nearly 31% in recent months.

Financial Snapshot

The current financial landscape for Intel presents a complex picture:

1. Earnings expectations are modest, with projections of $0.12 per share

2. This represents a significant 77.8% decrease from the previous year

3. Analysts predict a potential loss of $0.03 per share for the current quarter

“The semiconductor industry is in a state of constant flux, and Intel is navigating through challenging waters,” noted one market analyst.

Leadership and Market Challenges

Recent leadership changes have added another layer of intrigue to Intel’s story. The company recently underwent a significant management shake-up, with CEO Pat Gelsinger being replaced by co-CEOs David Zinsner and Michelle Johnston Holthaus. This transition comes at a critical time when the company is struggling to maintain its competitive edge in the semiconductor market.

Investor Sentiment

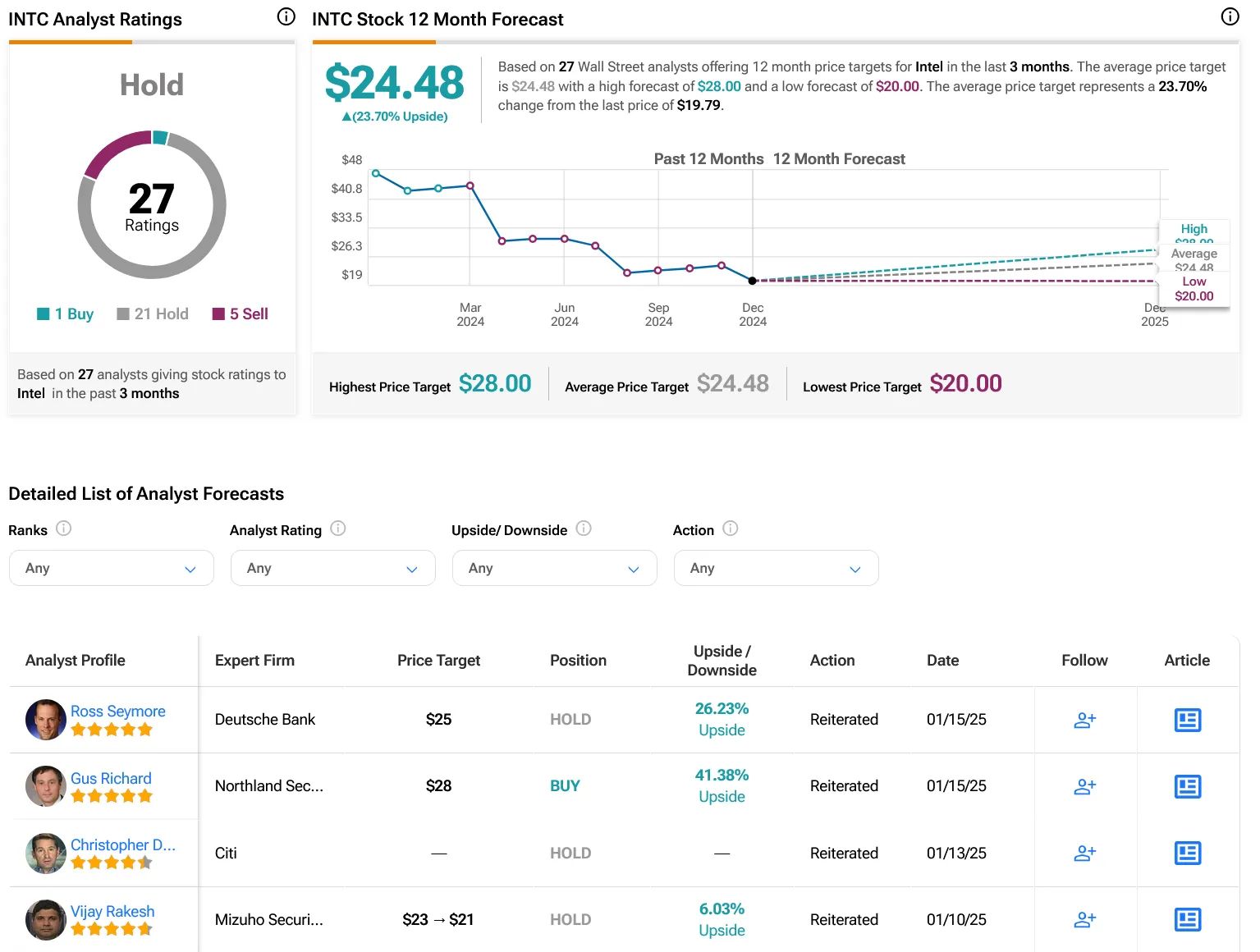

Wall Street’s current stance on Intel remains cautious:

– Buy ratings: 1

– Hold ratings: 21

– Sell ratings: 4

The average price target of $24.68 suggests a potential upside of 16.97%, offering a glimmer of hope for investors.

Competitive Landscape

Intel continues to face significant challenges in the highly competitive semiconductor industry. The company has experienced difficulties with its recent processor generations, leading to customer dissatisfaction and increased pressure from competitors. Despite these challenges, the potential acquisition rumors have injected a sense of optimism into the stock’s performance.

Trading Dynamics

The stock’s recent performance is nothing short of remarkable:

– Over 56 million shares traded

– Approaching the three-month daily average trading volume of 69.64 million units

– A 6.41% surge on recent trading day

Looking Ahead

While the road ahead remains uncertain, Intel’s recent stock movement demonstrates the volatile nature of the technology sector. Investors are advised to approach the stock with caution, carefully weighing the potential opportunities against the existing challenges.

Key Takeaways

- Acquisition speculation driving stock performance

- Leadership changes creating uncertainty

- Challenging market conditions persist

- Potential for future growth remains uncertain

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Final Thoughts

Intel’s current situation exemplifies the dynamic and unpredictable nature of the technology and semiconductor industries. While the recent stock surge provides a moment of excitement, investors must remain vigilant and informed about the company’s long-term prospects.

Leave a Comment