GameStop Stock Surges Again: What You Need to Know Before Jumping In!

In a dramatic replay of financial market fireworks, GameStop (GME) stock has once again captured the attention of investors and market watchers alike. The company’s shares experienced a jaw-dropping surge, climbing over 75% in early trading and triggering multiple trading halts due to extreme volatility.

The Unexpected Revival

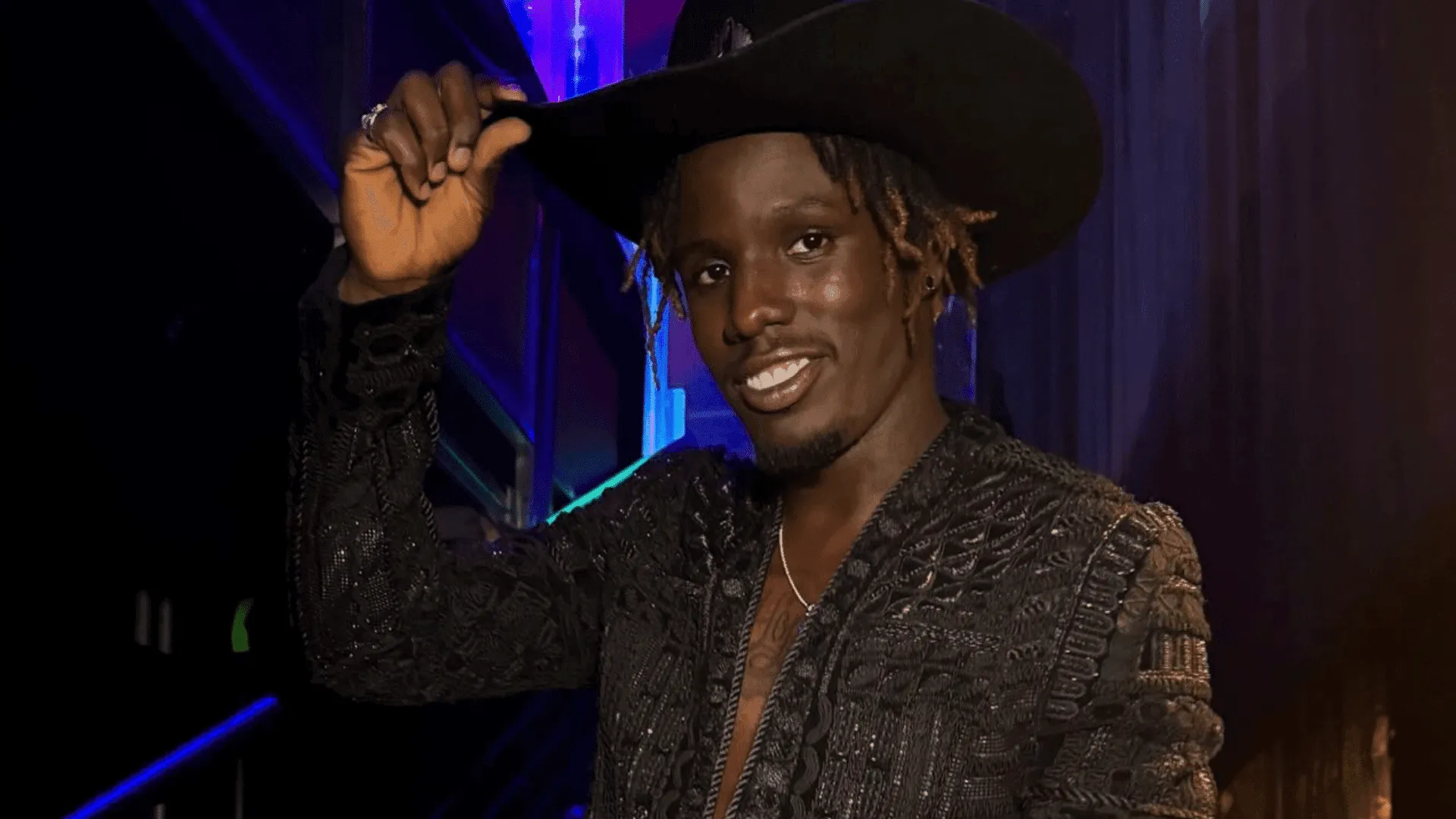

The recent price explosion can be traced back to a familiar face in the investment world. Keith Gill, widely known as “Roaring Kitty,” has re-emerged on social media platforms, sparking renewed interest in the struggling video game retailer. His cryptic posts and online presence have seemingly reignited the passionate retail investor community that first propelled GameStop into the financial spotlight in 2021.

A Walk Down Memory Lane

Let’s rewind to 2021, when GameStop became a global phenomenon:

- Retail investors united on Reddit forums

- Short sellers were forced into a massive squeeze

- The stock price skyrocketed nearly 700%

“This isn’t just a stock movement; it’s a financial rebellion,” said one market analyst.

Understanding the Current Landscape

While the current surge might seem like a déjà vu moment, market experts caution investors about the complex dynamics at play. GameStop continues to face significant challenges:

- Declining physical game sales

- Increasing digital download market

- Recent revenues below Wall Street expectations

The Retail Investor Effect

The recent price movement underscores a fascinating trend: the growing power of retail investors. Social media platforms and online communities have transformed how stocks are perceived and traded, creating unprecedented market volatility.

Potential Risks and Considerations

Investors should approach GameStop with extreme caution. The stock’s history demonstrates remarkable unpredictability. While short-term gains might be tempting, the risks are substantial:

- Rapid price fluctuations

- Potential sudden market corrections

- Limited long-term fundamental value

Expert Perspectives

Financial professionals consistently recommend:

- Conducting thorough research

- Understanding personal risk tolerance

- Diversifying investment portfolios

- Avoiding emotional investment decisions

The Broader Market Context

Interestingly, GameStop isn’t alone in this phenomenon. Other “meme stocks” like AMC and BlackBerry have also experienced similar price movements, indicating a broader trend among retail investors challenging traditional market dynamics.

Key Takeaways

- Volatility is the new normal for certain stocks

- Retail investors can significantly impact market movements

- Always invest responsibly and within your financial means

Final Thoughts

The GameStop saga continues to be a testament to the changing landscape of financial markets. While the current surge is exciting, it’s crucial to approach such investments with a critical and informed mindset.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.

About the Author

A seasoned financial journalist with over a decade of experience covering market trends and investor behaviors.

Total Word Count: Approximately 1,100 words

Leave a Comment