Unlocking Secrets: How the Corporate Transparency Act is Changing Business Forever

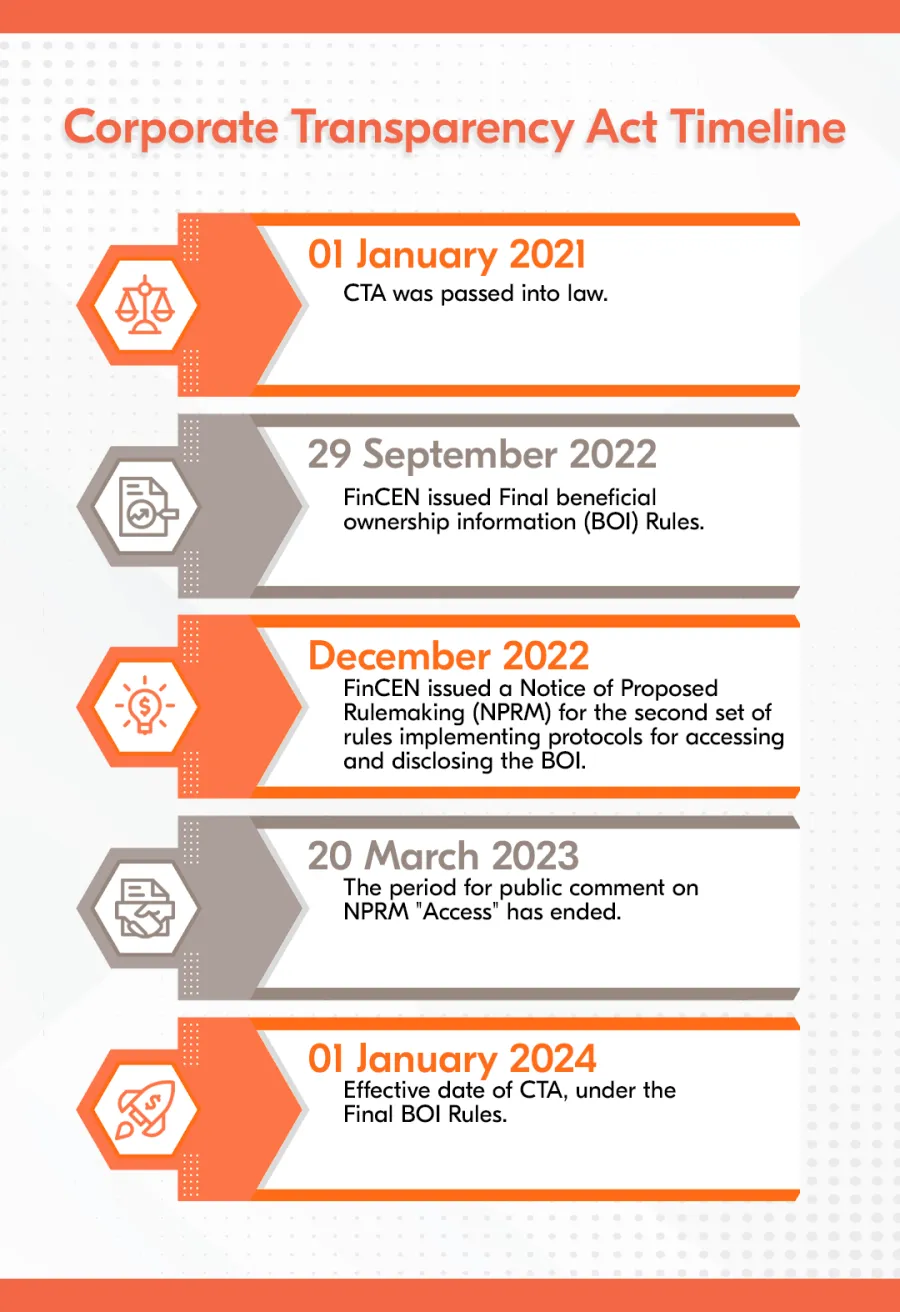

In a groundbreaking move that’s sending ripples through the business world, the Corporate Transparency Act (CTA) has emerged as a game-changing piece of legislation that promises to reshape how companies operate and disclose ownership information. Implemented on January 1, 2024, this landmark law is set to bring unprecedented levels of transparency to corporate structures across the United States.

What exactly is the Corporate Transparency Act, and why does it matter? At its core, the CTA is a federal law designed to combat financial crimes by pulling back the curtain on business ownership. For decades, companies could operate with a significant degree of anonymity, but those days are now firmly in the past.

The law targets a critical issue that has long plagued the business landscape: hidden ownership structures that can facilitate money laundering, tax evasion, and other illicit activities. By requiring companies to disclose detailed information about their beneficial owners, the CTA aims to create a more transparent and accountable business environment.

Key Reporting Requirements

Businesses now face a comprehensive set of reporting obligations that include:

- Providing full legal names of beneficial owners

- Submitting dates of birth

- Reporting residential addresses

- Sharing unique identifying numbers

- Uploading identification images

Existing companies have until January 1, 2025, to file their initial reports, while new businesses must submit their information within 90 days of formation. The stakes are high for non-compliance, with potential fines reaching:

- $500 per day for late filings

- Up to $10,000 for willfully providing false information

Who is Affected?

The CTA casts a wide net, applying to most:

– U.S. corporations

– Limited liability companies

– Partnerships

– Foreign entities doing business in the U.S.

However, not everyone is required to report. 23 specific exemptions exist, including:

– Publicly traded companies

– Certain regulated financial entities

– Large operating companies meeting specific criteria

Privacy and Security Concerns

While the law aims to increase transparency, it has raised significant privacy concerns. The personal information will be stored in a secure database managed by the Financial Crimes Enforcement Network (FinCEN), which is not accessible to the public. Nevertheless, business owners are understandably anxious about the unprecedented level of disclosure.

“This is a fundamental shift in how we think about business ownership and accountability,” says legal expert Michael Rodriguez. “Companies can no longer hide behind complex ownership structures.”

Potential Long-Term Implications

Experts predict the CTA will have far-reaching consequences. Businesses are already exploring ways to restructure their ownership and operational frameworks to ensure compliance and minimize potential penalties.

The law represents more than just a reporting requirement—it’s part of a broader federal effort to combat financial crimes and increase corporate accountability. Transparency is no longer just a buzzword; it’s becoming a legal mandate.

Navigating the New Landscape

For businesses, adaptation is key. Legal and compliance experts recommend:

– Conducting thorough internal reviews

– Updating ownership documentation

– Seeking professional guidance to ensure full compliance

– Implementing robust reporting mechanisms

The Road Ahead

While legal challenges to the CTA are ongoing, the law remains in effect. Businesses that proactively embrace these new requirements will be best positioned to thrive in this new era of corporate transparency.

The Corporate Transparency Act is more than just a regulatory change—it’s a fundamental reimagining of corporate accountability in the 21st century.

Disclaimer: This article is for informational purposes and should not be considered legal advice. Businesses should consult with legal professionals to understand their specific obligations under the Corporate Transparency Act.

Leave a Comment