Robinhood Soars to New Heights: Is Now the Time to Invest?

In recent weeks, Robinhood Markets, Inc. (HOOD) has captured the attention of investors and analysts alike, as its stock has surged approximately 30% since the beginning of November 2024. On November 8, 2024, the company reached a 52-week high of $30.63, prompting many to ask: is now the right time to invest in this popular trading platform?

Who is Robinhood?

Founded in 2013, Robinhood has revolutionized the trading landscape by offering commission-free trading and a user-friendly mobile app. The platform has become particularly popular among younger investors, especially during the meme stock phenomenon in early 2021. With over 10.8 million active users, Robinhood is now one of the most widely used trading apps in the United States.

What is Driving the Surge?

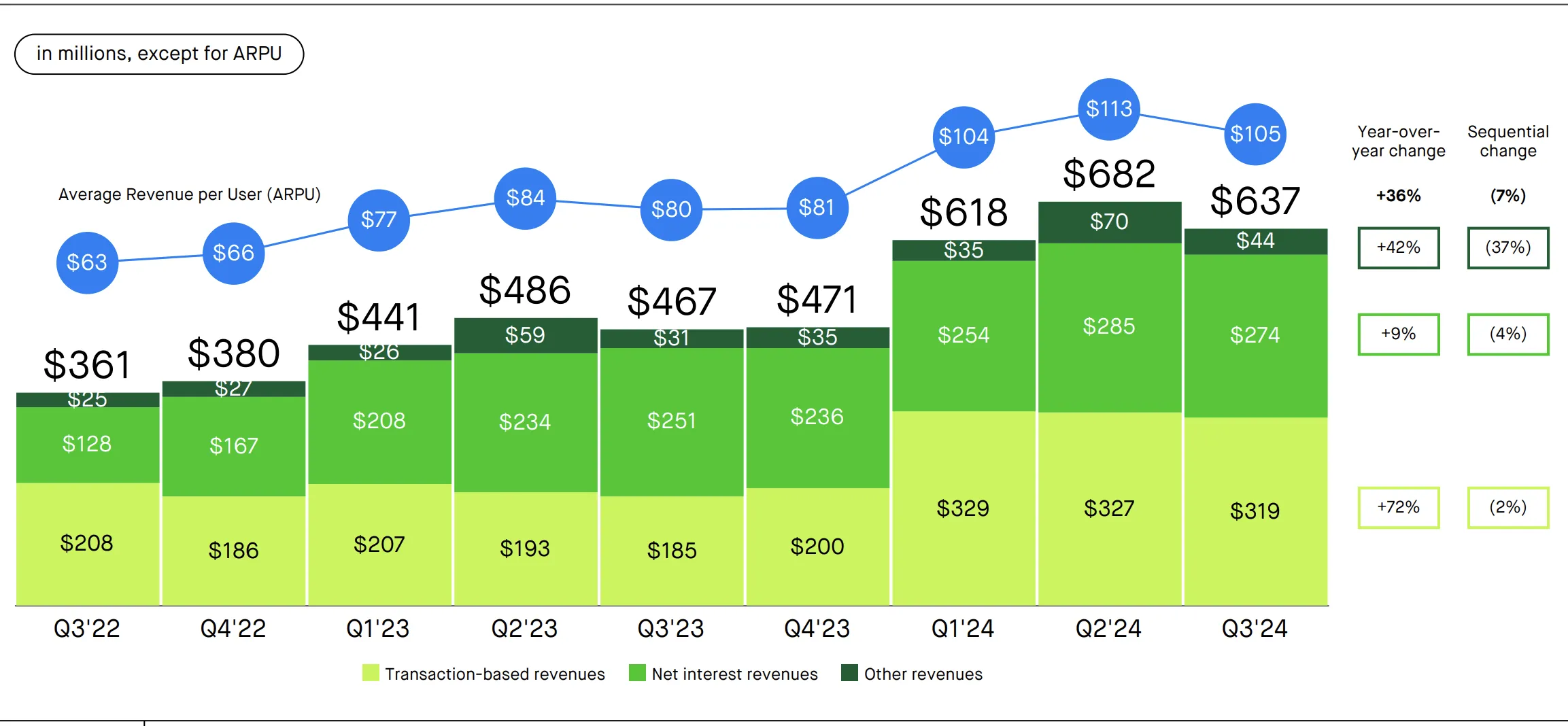

The recent surge in Robinhood’s stock price can be attributed to several factors. First and foremost, the company reported a compound annual growth rate (CAGR) of 61% in total net revenues from 2019 to 2023. This impressive growth is largely driven by transaction-based revenues, which have grown at a CAGR of 46.4% during the same period.

Additionally, Robinhood has seen a significant increase in its cryptocurrency revenues. In the first nine months of 2024, the company generated $268 million in cryptocurrency revenues, accounting for 13.8% of its total net revenues. This segment has experienced a remarkable CAGR of 94.2% since 2019, indicating a strong demand for digital assets among its user base.

When Did This Happen?

The stock’s upward trajectory began in early November 2024, coinciding with the recent U.S. presidential elections. The victory of Donald Trump has sparked optimism regarding increased investment in cryptocurrencies, which could further benefit Robinhood’s revenue streams as more investors enter the market.

Where Does Robinhood Stand Financially?

Despite facing challenges, including an annual net loss of $540 million, Robinhood reported revenues of $1.86 billion in 2023, marking a 37% increase year-over-year. This financial performance, coupled with a market capitalization of approximately $22.25 billion, reflects significant investor interest in the company.

Why Invest in Robinhood Now?

Investors are increasingly optimistic about Robinhood’s future growth potential. The company is diversifying its offerings beyond traditional brokerage services by introducing retirement accounts and credit card options. Furthermore, Robinhood has acquired Pluto Capital and plans to integrate Bitstamp to enhance its cryptocurrency services. These strategic moves position the company well for future growth.

How is User Engagement Evolving?

While Robinhood experienced a decline in user activity since its peak in 2021, recent trends indicate a recovery. Projections suggest that the platform could increase its user base to 11.8 million by the end of 2024. This resurgence in user engagement is crucial for sustaining revenue growth and maintaining investor confidence.

Conclusion: Is Now the Time to Invest?

As Robinhood continues to innovate and expand its service offerings, the question remains: is now the right time to invest? With a strong financial performance, a growing user base, and favorable market conditions, many analysts believe that Robinhood is well-positioned for future success. However, potential investors should carefully consider the risks associated with investing in a company that has faced scrutiny and challenges in the past.

In summary, Robinhood’s recent stock performance, coupled with its strategic initiatives and market positioning, makes it an intriguing option for investors looking to capitalize on the evolving trading landscape. As always, potential investors should conduct thorough research and consider their financial goals before making any investment decisions.

Leave a Comment