Polymarket’s Prediction Power: How Betting Markets Forecasted Trump’s Victory

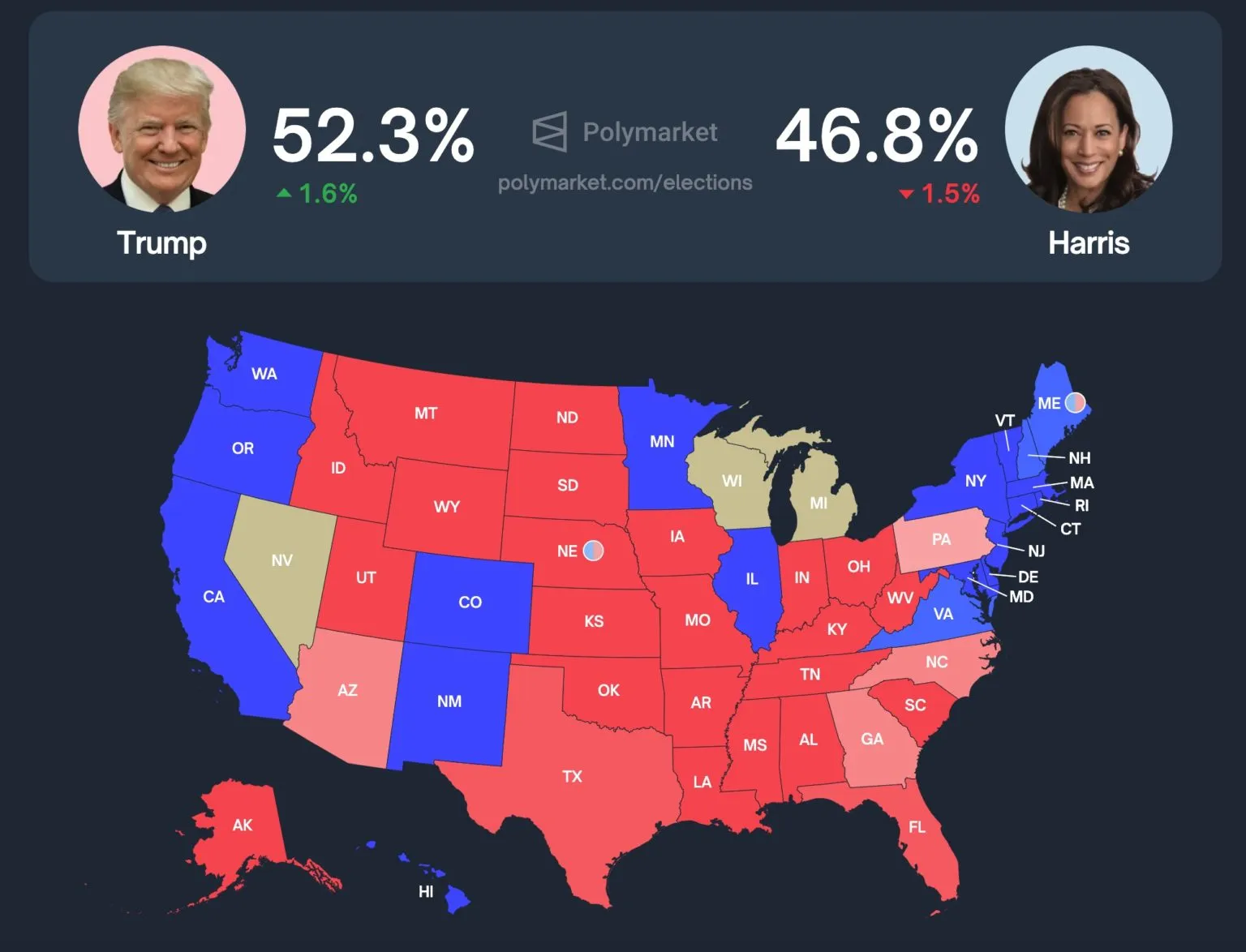

In the realm of political forecasting, Polymarket, a blockchain-based prediction market, has emerged as a significant player, particularly during the recent presidential election. As the election unfolded, Polymarket’s odds for Donald Trump’s victory surged from 58% to 95%, showcasing its predictive accuracy well ahead of traditional media calls. This article delves into how Polymarket and similar platforms are reshaping the landscape of election forecasting and the implications of their rise.

What is Polymarket?

Polymarket operates as a decentralized betting platform where users can wager on the outcomes of various events, including political elections. Unlike traditional polling methods, which often present a narrow view of voter sentiment, Polymarket aggregates the wisdom of the crowd, allowing users to place bets on specific outcomes. This peer-to-peer model creates a dynamic environment where the odds reflect real-time public sentiment.

How Did Polymarket Predict Trump’s Victory?

As election night approached, Polymarket’s odds indicated a clear lead for Trump, contrasting sharply with conventional polls that suggested a tight race. In the weeks leading up to the election, Polymarket assigned a 67% chance of victory to Trump, while Kamala Harris was given a 33% chance. This divergence highlights the platform’s ability to capture shifts in public sentiment more effectively than traditional polling methods.

The Volume of Betting

The engagement on Polymarket was staggering, with nearly $3.7 billion worth of contracts traded related to the presidential election. This volume underscores the growing interest in prediction markets as tools for forecasting electoral outcomes. As more individuals turn to these platforms, the data generated can provide insights that traditional polls may overlook.

What Sets Polymarket Apart?

One of the key differentiators for Polymarket is its regulatory landscape. A recent U.S. federal court ruling favored prediction markets, allowing platforms like Kalshi to offer event contracts. This ruling has opened new avenues for betting on elections, enhancing competition among prediction markets and legitimizing their role in political forecasting.

Market Dynamics and Integrity

Shayne Coplan, CEO of Polymarket, emphasized that the platform operates on a peer-to-peer basis. This means that large bets on one candidate are balanced by significant positions on others, mitigating concerns about market manipulation by a few bettors. This structure fosters a more accurate reflection of public sentiment, as the market adjusts to the collective actions of its participants.

Public Perception and Future Prospects

Following the election cycle, Coplan expressed hope that Polymarket’s successful predictions would lead to greater public acceptance of market-based information as a reliable forecasting method. As more people become aware of the predictive power of these platforms, the stigma surrounding betting markets may diminish.

Expansion Plans

Despite currently not being available to U.S. residents, Polymarket has ambitious plans for expansion. With a potential Trump administration expected to be more favorable toward online betting and cryptocurrencies, the platform is poised to capitalize on this environment. The alignment with cryptocurrency enthusiasts further bolsters its user base, as Trump’s pro-crypto stance could enhance operational capabilities in the U.S.

The Ethical Debate

However, the rise of election betting markets has not been without controversy. Regulators have raised concerns about the potential influence of financial gain on electoral outcomes. This ongoing debate about the ethical implications of such platforms is crucial as society navigates the intersection of finance and politics.

Comparison with Other Markets

Polymarket is not alone in this space. Other platforms, such as Interactive Brokers and Robinhood, have also entered the election betting arena, indicating a growing trend in how financial markets intersect with political forecasting. This convergence raises questions about the future of political engagement and the role of betting markets in shaping public opinion.

Conclusion

Polymarket’s ability to accurately forecast Trump’s victory demonstrates the potential of prediction markets as a valuable tool for election forecasting. As the landscape of political betting evolves, the implications for public perception, regulatory frameworks, and ethical considerations will continue to unfold. With a significant volume of betting and a growing acceptance of market-based information, Polymarket is at the forefront of a new era in political forecasting, challenging traditional methods and reshaping how we understand electoral outcomes.

In a world where information is power, platforms like Polymarket are redefining the rules of engagement, offering a glimpse into the future of political prediction and the role of decentralized betting in shaping our democratic processes.

Leave a Comment