Unlocking the Secrets: How to Maximize Your 401(k) Before It’s Too Late!

As the landscape of retirement planning continues to evolve, many individuals are seeking ways to enhance their 401(k) savings before it’s too late. With new contribution limits set for 2025 and various strategies available, understanding how to effectively utilize a 401(k) plan can significantly impact your financial future. This article delves into the essential components of maximizing your 401(k), ensuring you are well-equipped to make informed decisions.

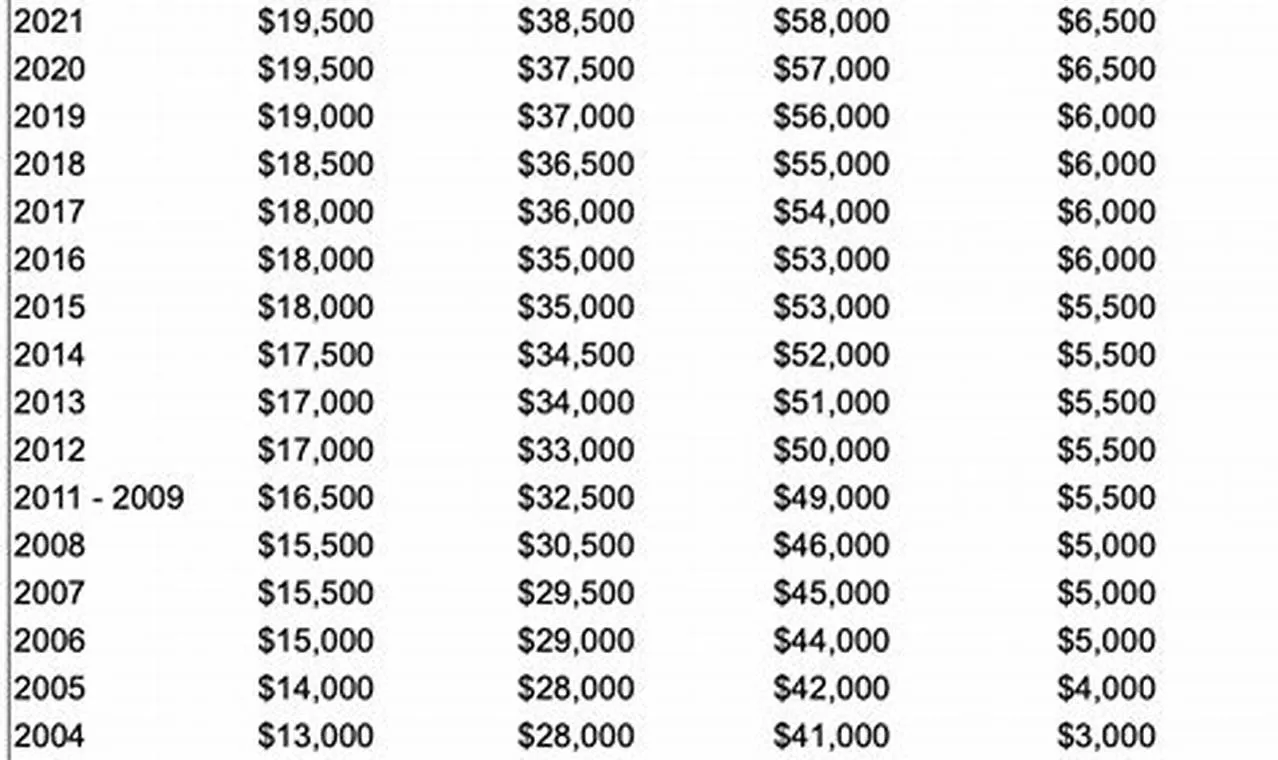

The 401(k) is a popular retirement savings plan that allows employees to save a portion of their paycheck before taxes are taken out. This tax-deferred growth can be a powerful tool in building a nest egg for retirement. As of 2025, the contribution limit for 401(k) plans will increase, providing individuals with an excellent opportunity to save even more for their future. This change underscores the importance of staying informed about evolving regulations and maximizing benefits.

For those aged 50 and older, the opportunity to make catch-up contributions becomes crucial. These additional contributions can significantly enhance retirement savings, allowing older workers to bolster their financial security as they approach retirement age. By taking advantage of this provision, individuals can effectively counterbalance any late starts in their retirement savings journey.

One of the most effective strategies for maximizing a 401(k) is to fully utilize employer matching contributions. Many employers offer matching funds, which can be viewed as free money that enhances your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, that’s an immediate return on your investment. Failing to take full advantage of this benefit could mean leaving significant money on the table.

Diversification is another key element in maximizing your 401(k) plan. By carefully selecting a mix of investment choices, including stocks, bonds, and mutual funds, you can balance risk with growth potential. This strategy not only helps mitigate losses during market downturns but also positions your portfolio for long-term success. Regularly reviewing and adjusting your investment options based on market conditions and personal financial goals is essential for maintaining a healthy retirement portfolio.

Setting up automatic contributions to your 401(k) can also ensure consistent saving. This approach allows you to take advantage of dollar-cost averaging, which can reduce the impact of market volatility on your investments. By making regular contributions, you can steadily build your retirement savings without the stress of market timing.

However, it is crucial to remain vigilant about the fees and expenses associated with your 401(k) plan. High fees can erode your investment returns over time, making it essential to understand the costs involved. Regularly reviewing your plan’s fees and seeking lower-cost investment options can make a significant difference in your overall savings.

Understanding the tax benefits of contributing to a 401(k) is also vital. Contributions are made pre-tax, allowing for tax-deferred growth until withdrawal. This means you can potentially reduce your taxable income in the years you contribute, while also enjoying the benefits of compound growth on your investments. Familiarizing yourself with the rules regarding withdrawals, including penalties for early withdrawal and required minimum distributions (RMDs), is equally important to avoid unexpected financial pitfalls in the future.

Finally, investing in your financial education can provide you with the knowledge needed to make informed decisions about your retirement savings strategy. Numerous resources are available, from online courses to financial advisors, that can help demystify the complexities of retirement planning. Taking the time to educate yourself about your 401(k) options can empower you to make choices that align with your long-term financial goals.

In conclusion, maximizing your 401(k) is not just about knowing the rules but actively engaging with your retirement savings strategy. With the impending changes in contribution limits for 2025, now is the time to take action. By leveraging employer matches, diversifying investments, setting automatic contributions, and staying informed about fees and tax benefits, you can significantly enhance your retirement savings. Don’t wait until it’s too late—start implementing these strategies today to unlock the full potential of your 401(k) and secure a more comfortable retirement.

Leave a Comment