Unlocking the Secrets: How Social Security Benefits Could Change Your Life in 2025!

In a significant development for millions of Americans, the Social Security Administration (SSA) has announced a 2.5% increase in Social Security benefits and Supplemental Security Income (SSI) payments for over 72.5 million beneficiaries starting in 2025. This annual cost-of-living adjustment (COLA) reflects moderated inflation rates, which have a direct impact on benefit growth. As we look ahead to 2025, understanding these changes could be crucial for many individuals relying on Social Security for their financial stability.

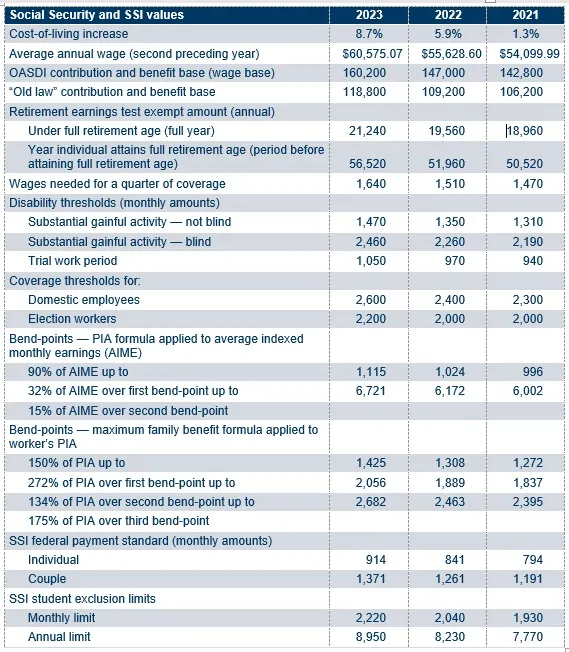

The 2.5% COLA increase, which translates to an average of approximately $50 per month for retirees, will take effect in January 2025. This adjustment is relatively modest compared to previous years, where beneficiaries experienced larger increases due to higher inflation rates. For instance, the 2024 COLA was 3.2%, indicating a trend towards moderated inflation that is influencing benefit adjustments.

For those receiving SSI, the increase will begin even earlier, with payments starting on December 31, 2024. This early adjustment is designed to help some of the most vulnerable populations manage their living costs during the winter months. The SSA has committed to informing beneficiaries of their new benefit amounts by mail starting in early December 2024, ensuring that recipients are well-prepared for the changes.

In addition to the COLA increase, several other significant changes are slated for 2025. The maximum amount of earnings subject to the Social Security tax will rise from $168,600 to $176,100. This adjustment will particularly affect higher-earning workers, as they will contribute more towards the Social Security system. Furthermore, the earnings limit for workers younger than full retirement age will increase to $23,400, with a deduction of $1 from benefits for every $2 earned over this limit.

For those reaching full retirement age in 2025, the monthly earnings limit will be set at $62,160, with a deduction of $1 for every $3 earned over this threshold until the month they turn full retirement age. These changes are designed to ensure that the Social Security system remains sustainable while also providing fair benefits to retirees and workers alike.

The SSA has acknowledged that the upcoming changes will impact both current retirees and working Americans. Nearly 68 million Social Security beneficiaries will see the 2.5% COLA beginning in January 2025, while nearly 7.5 million SSI recipients will benefit from the increased payments starting at the end of December. The adjustments are calculated based on the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which reflects the cost of living for many beneficiaries.

Despite these positive changes, challenges remain. The SSA has reported potential delays in processing new retirement applications, although the specific reasons for these delays have not been disclosed. This could create uncertainty for those planning to retire or transition to Social Security benefits in the near future.

Moreover, the changes in Social Security benefits will also have implications for Medicare in 2025, although the exact details of these adjustments have yet to be announced. As Medicare and Social Security are closely linked, any alterations to one program can significantly affect the other, making it essential for beneficiaries to stay informed.

In light of these developments, it is crucial for beneficiaries to remain proactive about their Social Security benefits. The SSA emphasizes the importance of reporting any changes in income or personal circumstances that may affect eligibility. Beneficiaries can conveniently access their COLA notices online through their personal my Social Security accounts, providing a secure platform to manage their benefits.

Looking ahead, it is worth noting that while the 2025 COLA increase is a welcome adjustment for many, the SSA has indicated that significant changes to Social Security policies may be on the horizon beyond 2025. With projections suggesting funding challenges for the program by 2034, it is imperative for beneficiaries to stay informed about potential reforms that could impact their future benefits.

In conclusion, the 2.5% increase in Social Security benefits for 2025 is a crucial development that promises to enhance the financial well-being of millions of Americans. While the increase may be smaller than in previous years, it underscores the importance of adapting to changing economic conditions. As beneficiaries prepare for these adjustments, staying informed and proactive will be key to navigating the evolving landscape of Social Security benefits.

Leave a Comment