Dow Jones Dips: What’s Driving the Market Madness Today?

The Dow Jones Industrial Average (DJIA), a crucial barometer of the U.S. stock market, has recently experienced a notable dip, sinking nearly 450 points. This downturn has left investors and analysts alike pondering the causes behind this market volatility. As we delve into the factors influencing this decline, it’s essential to understand the broader context of the stock market’s health and the economic landscape.

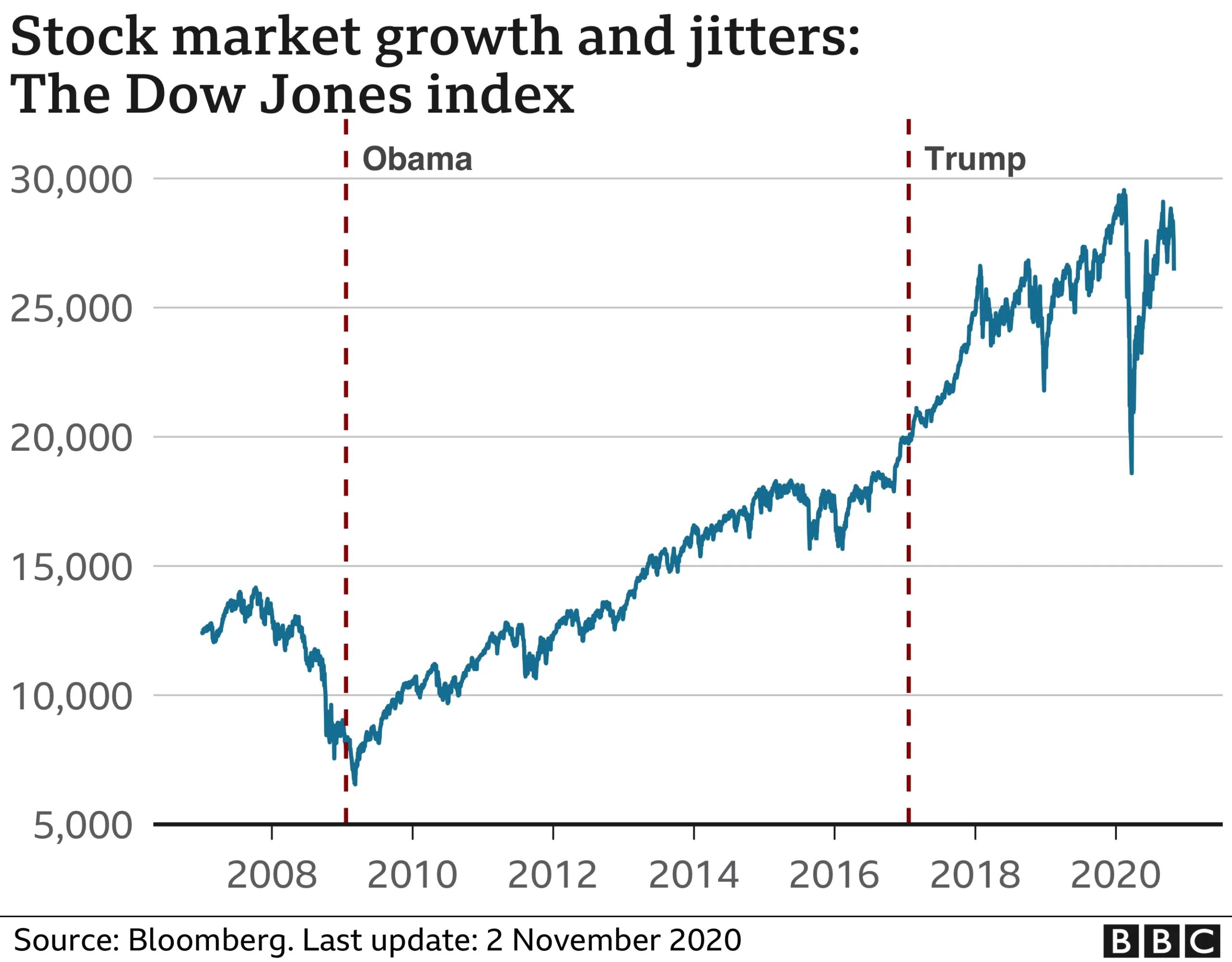

The DJIA, established in 1896, is a key indicator of the stock market’s performance and the overall health of the U.S. economy. It tracks the stock prices of 30 large, publicly traded companies, making it one of the most widely referenced indices. Recent market fluctuations have raised concerns, particularly amid perplexing economic news and shifts in monetary policy by the Federal Reserve. Investors are navigating a complex environment filled with uncertainty, prompting questions about the future trajectory of the market.

Recent reports indicate that the market’s decline can be attributed to several interrelated factors. Investor jitters have been exacerbated by unsettling economic indicators, including rising inflation rates and potential interest rate changes. The Federal Reserve’s decisions regarding monetary policy are under close scrutiny, as they hold significant sway over market dynamics. Analysts suggest that the current volatility may also stem from profit-taking after a strong rally earlier in the year, where some indexes saw gains exceeding 21%.

In addition to domestic factors, geopolitical events have historically influenced market performance. The ongoing war in Ukraine and supply chain disruptions stemming from the pandemic have created a backdrop of uncertainty. Such global events can ripple through the stock market, impacting investor sentiment and decision-making. As a result, the market’s reaction to these developments is critical for understanding its current state.

Despite the recent downturn, it is important to note that the U.S. stock market had seen substantial gains earlier in the year. The disparity between the stock market’s performance and the economic reality for average Americans raises questions about the true health of the economy. While the DJIA may reflect optimism among large corporations, many individuals continue to face financial challenges, leading to a disconnect between market performance and everyday experiences.

As investors closely monitor economic indicators, the upcoming economic calendar is set to play a pivotal role in shaping market sentiment. Key reports on consumer confidence and jobless claims are anticipated, and their outcomes could either bolster or further undermine investor confidence. Market experts emphasize the importance of diversification in investment strategies during these periods of heightened volatility, encouraging investors to spread their risk across various assets.

In the technology sector, companies like Nvidia have faced pressure, with stagnant stock prices reflecting broader market concerns. The semiconductor industry, pivotal to technological advancement, is experiencing challenges that may hinder its growth trajectory. Additionally, the cryptocurrency market is feeling the heat, with Bitcoin recently dropping to its lowest level since November, indicating a broader sense of caution among investors.

The interplay of global events, such as inflationary pressures in Europe and Asia, further complicates the situation. These external factors contribute to the uncertainty felt by U.S. investors, as they grapple with the implications of international economic dynamics. As the Federal Reserve prepares for upcoming meetings, its statements and decisions will be closely watched, as they hold the potential to either stabilize or further disrupt the markets.

In conclusion, the recent dip in the Dow Jones Industrial Average highlights the complexities of the current market environment. With a mix of optimism and caution, investors are weighing potential recovery against ongoing economic challenges. As the market continues to react to both domestic and global influences, understanding the underlying factors driving these trends will be crucial for navigating the path ahead. The coming weeks will be pivotal, and all eyes will remain on the economic indicators and Federal Reserve actions that could shape the future of the stock market.

In summary, the current state of the Dow Jones reflects a broader narrative of uncertainty and volatility. As investors seek clarity amid the chaos, the interplay of economic indicators, corporate earnings, and geopolitical events will remain at the forefront of market discussions. The journey ahead may be fraught with challenges, but with careful analysis and strategic planning, investors can navigate these turbulent waters.

Leave a Comment