Hims & Hers Earnings Surprise: Why Shares Plummeted 15% After Strong Results

Hims & Hers Health, a prominent player in the telehealth industry, recently reported its fourth-quarter earnings, showcasing impressive financial performance that exceeded analysts’ expectations. Revenue for the quarter reached $481 million, a remarkable 95% increase from $246.6 million during the same period last year. The company also reported earnings per share (EPS) of 11 cents, slightly surpassing the anticipated 10 cents. Despite these strong results, shares of Hims & Hers fell by approximately 15% in after-hours trading, leaving many investors puzzled.

The decline in the stock price can be attributed to a miss in profit margins. Hims & Hers reported a gross margin of 77%, which fell short of the expected 78.4%. This discrepancy raised concerns among investors about the company’s ability to maintain its profitability amidst increasing competition in the telehealth space. Andrew Dudum, CEO of Hims & Hers, acknowledged the challenges posed by regulatory changes, particularly regarding the company’s GLP-1 offerings, which have been a significant contributor to its growth.

In the context of recent market volatility, Hims & Hers’ stock had already experienced a significant drop of over 25% earlier in the month due to announcements from the FDA regarding the availability of semaglutide. Analysts had anticipated a rebound in stock performance following the earnings report, but the margin miss overshadowed the positive results. The market’s reaction reflects broader investor sentiment regarding the healthcare sector’s performance and future outlook.

Key Highlights from Hims & Hers Earnings Report

- Revenue Growth: The company achieved a 95% increase in revenue year-over-year.

- Earnings Per Share: Reported EPS of 11 cents, slightly above expectations.

- Gross Margin: The gross margin of 77% fell short of the anticipated 78.4%.

- GLP-1 Revenue: Generated over $225 million in revenue from GLP-1 offerings in 2024.

- Future Projections: Hims & Hers anticipates first-quarter revenue between $520 million and $540 million, surpassing analysts’ expectations of $497 million.

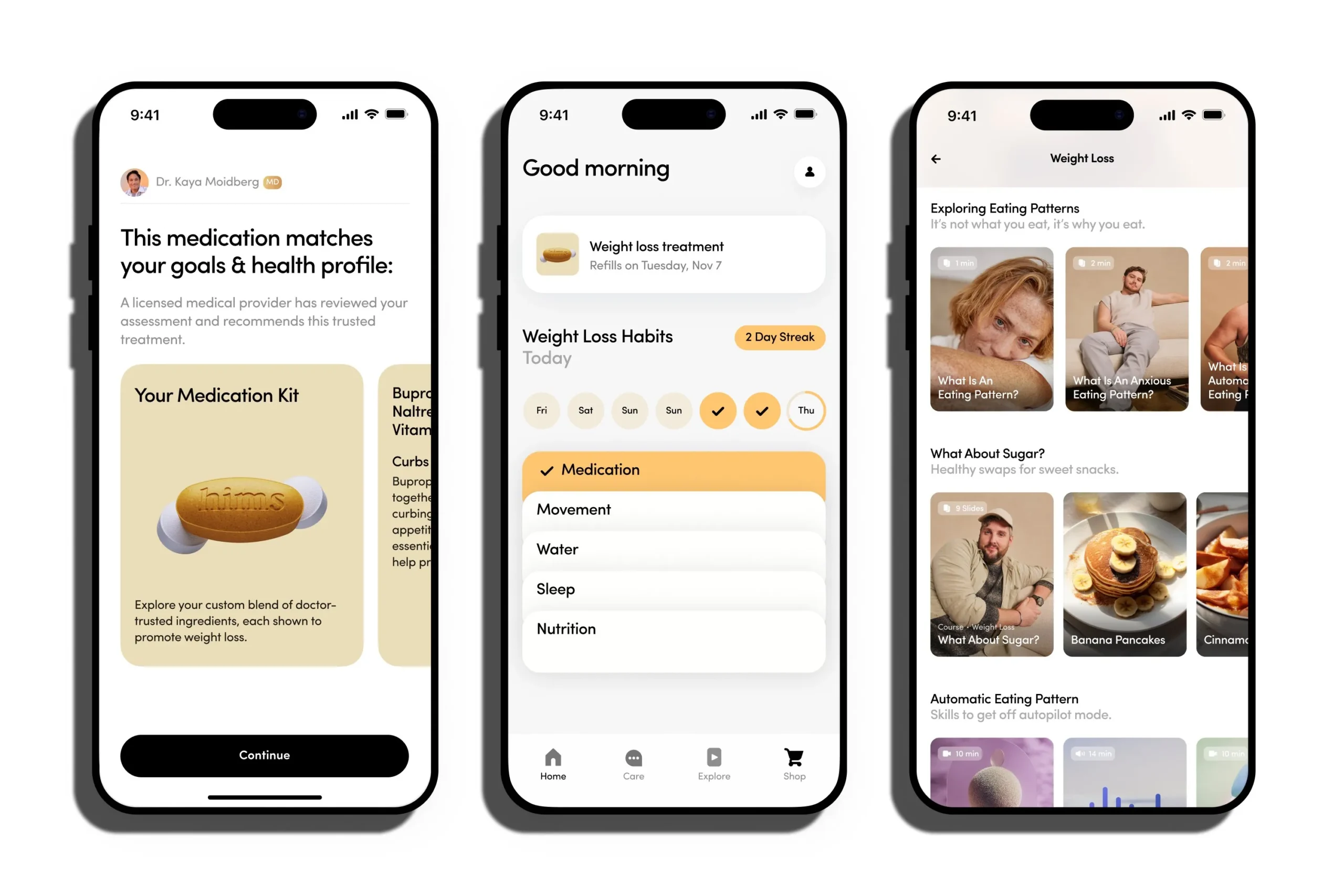

Despite the strong revenue performance, investors are increasingly concerned about the sustainability of Hims & Hers’ growth, particularly in light of the challenges facing its GLP-1 business. The company plans to introduce a generic medication, liraglutide, to its weight loss offerings, aiming for at least $725 million in revenue from this segment in 2025. However, the potential discontinuation of compounded semaglutide due to regulatory changes has raised red flags for future revenue streams.

Hims & Hers’ non-GLP-1 product revenue also showed promise, increasing by 43% to $1.2 billion for the full year. This indicates strong performance in other health sectors, which could help mitigate the impact of challenges in the GLP-1 market. Nevertheless, the company’s ability to adapt to regulatory changes and maintain its competitive edge in the telehealth market remains critical.

Investor Sentiment and Market Trends

The recent stock performance of Hims & Hers reflects a broader trend of volatility in the digital health sector. The company had previously experienced a 200% increase in stock value over the past year, but the recent earnings report has raised questions about its future trajectory. Investors are closely monitoring the company’s ability to navigate regulatory hurdles and maintain growth amidst increasing competition.

The healthcare sector is undergoing significant changes, and investor sentiment is shifting as companies like Hims & Hers face new challenges. The decline in stock price following a strong earnings report highlights the delicate balance between operational performance and market expectations. As Hims & Hers continues to innovate and expand its offerings, it must also address the concerns of its investors to regain confidence in its growth prospects.

In conclusion, while Hims & Hers Health reported strong earnings that exceeded expectations, the subsequent decline in its stock price underscores the complexities of the current market environment. Investors are increasingly wary of the company’s ability to sustain its growth, particularly in light of regulatory challenges and competition in the telehealth space. As the company navigates these hurdles, its future performance will depend on its ability to adapt and innovate in a rapidly evolving healthcare landscape.

Leave a Comment