Unlocking 2025: How New Tax Brackets Will Change Your Paycheck Forever!

In a significant development for American taxpayers, the Internal Revenue Service (IRS) has unveiled the tax brackets for 2025, promising subtle yet impactful changes that could reshape household financial planning. The upcoming fiscal adjustments are more nuanced than dramatic, but they carry important implications for millions of workers across the United States.

Key Highlights of 2025 Tax Landscape

The new tax structure for 2025 maintains the existing seven federal income tax rates:

1. 10%

2. 12%

3. 22%

4. 24%

5. 32%

6. 35%

7. 37%

What makes these brackets unique is the 2.8% inflation adjustment, which aims to prevent what tax experts call “bracket creep” – a phenomenon where inflation pushes taxpayers into higher tax brackets without real income increases.

Standard Deduction Changes

For married couples filing jointly, the standard deduction will increase to $30,000, up from $29,200 in 2024. Single filers will see their standard deduction rise to $15,000, representing a modest but meaningful adjustment.

“These incremental changes might seem small, but they can add up to significant savings for taxpayers,” says Michael Rodriguez, a senior tax analyst at the Tax Policy Center.

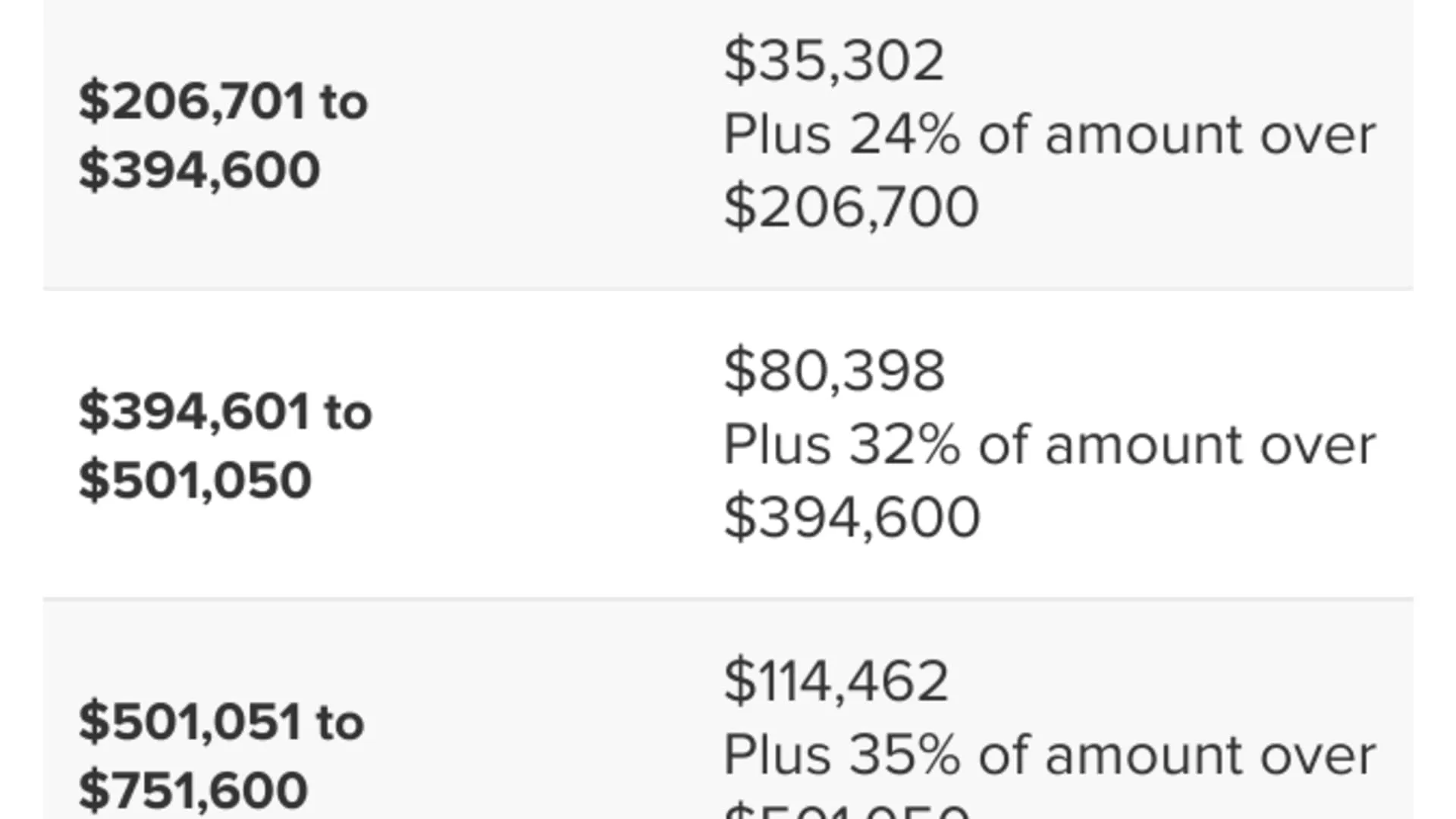

Income Thresholds and Marginal Rates

The top marginal tax rate of 37% will apply to:

– Single filers with taxable income over $626,350

– Married couples filing jointly with income exceeding $751,600

Earned Income and Child Tax Credits

The tax landscape for 2025 also includes noteworthy adjustments to tax credits:

– Child Tax Credit: Remains at $2,000 per qualifying child

– Refundable Portion: $1,700

– Earned Income Tax Credit (EITC): Maximum amount for three or more qualifying children increases to $8,046

Impact on Paychecks

While the changes are designed to provide slight relief, financial experts caution that the impact might be minimal. Rising costs in essential goods and services could offset potential gains, making the tax adjustments feel less substantial for many Americans.

Planning and Preparation

The IRS recommends that taxpayers:

1. Monitor federal and state tax withholdings

2. Review personal financial situations

3. Consider consulting a tax professional

4. Stay informed about potential legislative changes

Alternative Minimum Tax (AMT) Considerations

The phaseout for the AMT exemption begins at:

– $626,350 for single filers

– $1,252,700 for married couples filing jointly

The Bigger Picture

These tax bracket adjustments reflect the government’s ongoing effort to account for inflation and provide incremental financial relief. The Chained Consumer Price Index (C-CPI) continues to play a crucial role in determining these annual modifications.

Expert Insight

“Understanding these nuanced changes is critical for effective financial planning,” notes Sarah Thompson, a leading tax strategist. “While the adjustments might seem minor, they can significantly impact long-term financial strategies.”

Conclusion

The 2025 tax brackets represent a measured approach to fiscal policy, balancing inflation adjustments with maintaining existing tax structures. Taxpayers should remain proactive, informed, and prepared to optimize their financial planning in light of these changes.

Stay informed, plan wisely, and make the most of your 2025 tax strategy!

Disclaimer: This article provides general information and should not be considered definitive tax advice. Always consult with a qualified tax professional for personalized guidance.

Leave a Comment