Is QQQ Stock the Next Big Investment? Discover What Experts Are Saying!

The Invesco QQQ ETF, which tracks the performance of the NASDAQ-100 Index, has been making headlines recently as investors seek opportunities in the rapidly evolving technology sector. With its heavy weighting towards megacap technology companies, including industry giants like Amazon and Apple, many are asking if QQQ stock is the next big investment.

The ETF has shown impressive year-to-date gains of approximately 26.65%, driven largely by its focus on artificial intelligence (AI) and tech growth. Over the past year, QQQ has risen about 30.6%, indicating strong long-term performance despite a recent 2.51% decline in the past week. This volatility has led analysts to weigh the risks and rewards associated with investing in QQQ.

Experts consider QQQ a solid investment option, especially for those looking to capitalize on trends in AI and technology. The ETF seeks to match the performance of the NASDAQ-100 Index, which includes 100 of the largest domestic and international non-financial companies. This concentration in tech-related stocks has resulted in a performance that has consistently outpaced traditional diversified portfolios, with QQQ showing a 20% increase compared to a 5.6% gain in a typical 60-40 diversified portfolio.

The Potential for Growth

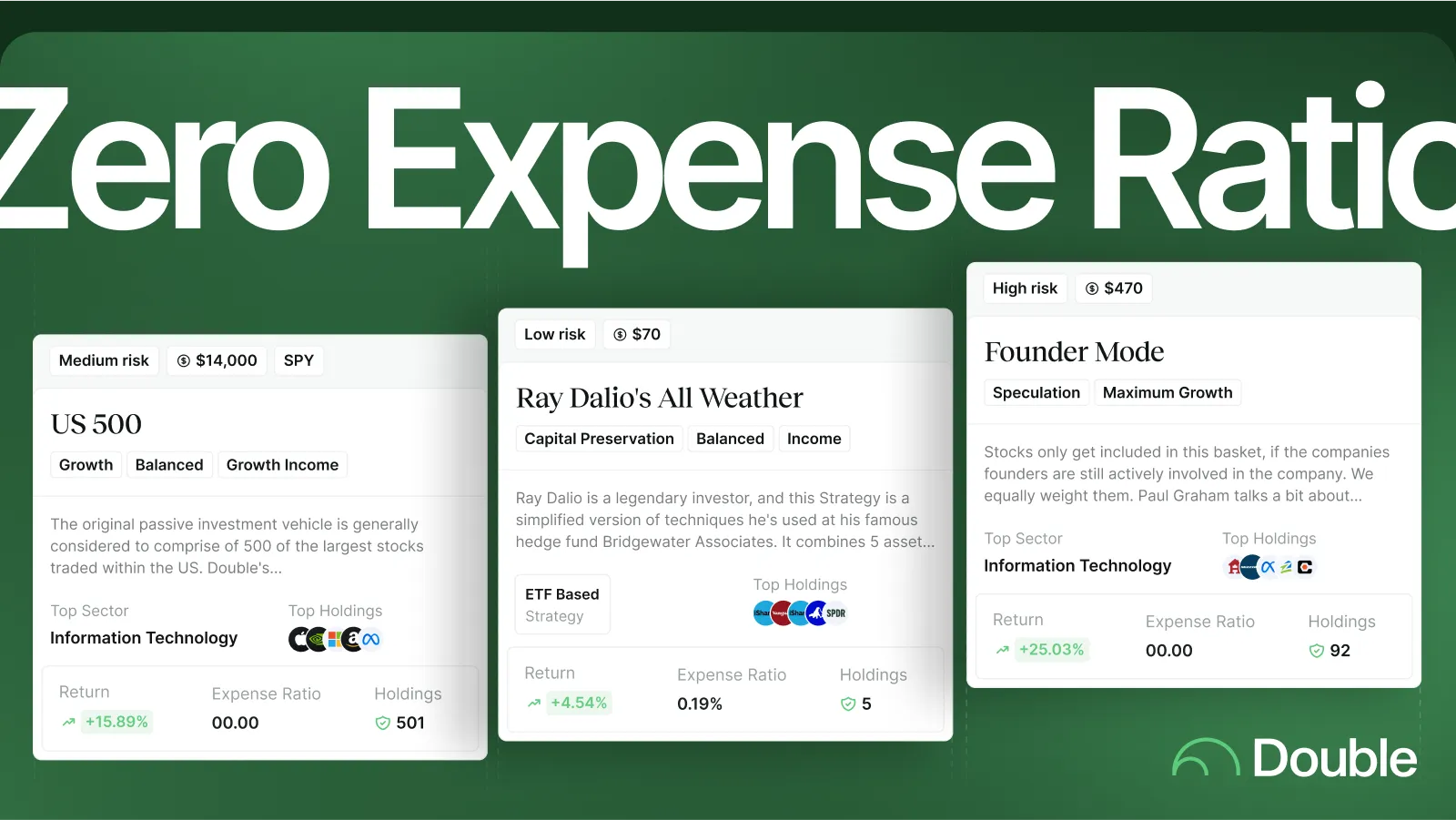

Many analysts view QQQ as a potential “millionaire maker” due to its historical performance and growth potential in the tech sector. The ETF has averaged around 20% annual returns over the past decade, making it an attractive option for investors. Its relatively low expense ratio of 0.20% further enhances its appeal, particularly for cost-conscious investors.

Moreover, the quarterly outlook for QQQ suggests continued optimism among strategists, with expectations for further growth in the tech sector. Recent trends indicate a growing interest in sustainable and responsible investing, with QQQ incorporating Environmental, Social, and Governance (ESG) factors into its investment strategy. This shift could attract a new wave of investors looking for ethical investment opportunities.

Risks and Considerations

However, investing in QQQ is not without its risks. Analysts highlight concerns about market volatility and the concentration of holdings in a few sectors. The ETF’s performance is closely tied to the overall health of the U.S. economy, with economic indicators such as GDP growth and unemployment rates significantly impacting its value. Investors are advised to keep an eye on interest rate changes, as rising rates can negatively affect growth stocks, including those in QQQ.

Despite these risks, the liquidity of QQQ is high, allowing investors to buy and sell shares easily, which is crucial for active traders. Additionally, while the ETF is heavily tech-focused, it does provide some level of risk mitigation through diversification, including exposure to other sectors like consumer discretionary and healthcare.

Expert Opinions

Experts have weighed in on the future of QQQ, with many expressing a positive outlook. “Investors who are looking to capitalize on the advancements in technology, particularly in areas like cloud computing and cybersecurity, should consider QQQ as a viable option,” says a leading market analyst. Furthermore, the ETF has been a popular choice during market recoveries, as tech stocks tend to rebound faster than other sectors.

In summary, while QQQ presents a compelling investment opportunity with its strong track record and focus on growth sectors, potential investors should carefully consider the associated risks. The market’s volatility and sector-specific challenges are factors that cannot be overlooked.

Conclusion

In conclusion, QQQ stock stands out as a potential big investment for those looking to navigate the tech landscape. With its impressive performance metrics, low expense ratio, and focus on AI and tech growth, it offers a unique opportunity. However, investors must remain vigilant about the risks involved, particularly in a fluctuating market. As always, conducting thorough research and consulting with financial advisors is advisable before making any investment decisions.

With the current trajectory of technological advancements and the ongoing recovery of the market, QQQ may indeed be the next big investment for those ready to embrace the opportunities it presents.

Leave a Comment