Bitcoin 2025: Will It Soar to $250,000 This Year?

In a landscape of unprecedented cryptocurrency excitement, Bitcoin stands on the precipice of a potentially historic price surge that could redefine digital asset investments.

The cryptocurrency world is buzzing with anticipation as Tom Lee, head of research at Fundstrat, makes a bold prediction that could send shockwaves through financial markets. His forecast suggests Bitcoin might reach an astounding $250,000 by the end of 2025, a projection that has captured the attention of investors and analysts worldwide.

The Perfect Storm of Factors

Several critical developments are converging to create an optimistic outlook for Bitcoin:

- SEC Spot Bitcoin ETF Approval: The landmark decision in 2024 dramatically increased liquidity and mainstream investor interest.

- Institutional Adoption: Major firms like BlackRock and MicroStrategy have strategically added Bitcoin to their balance sheets.

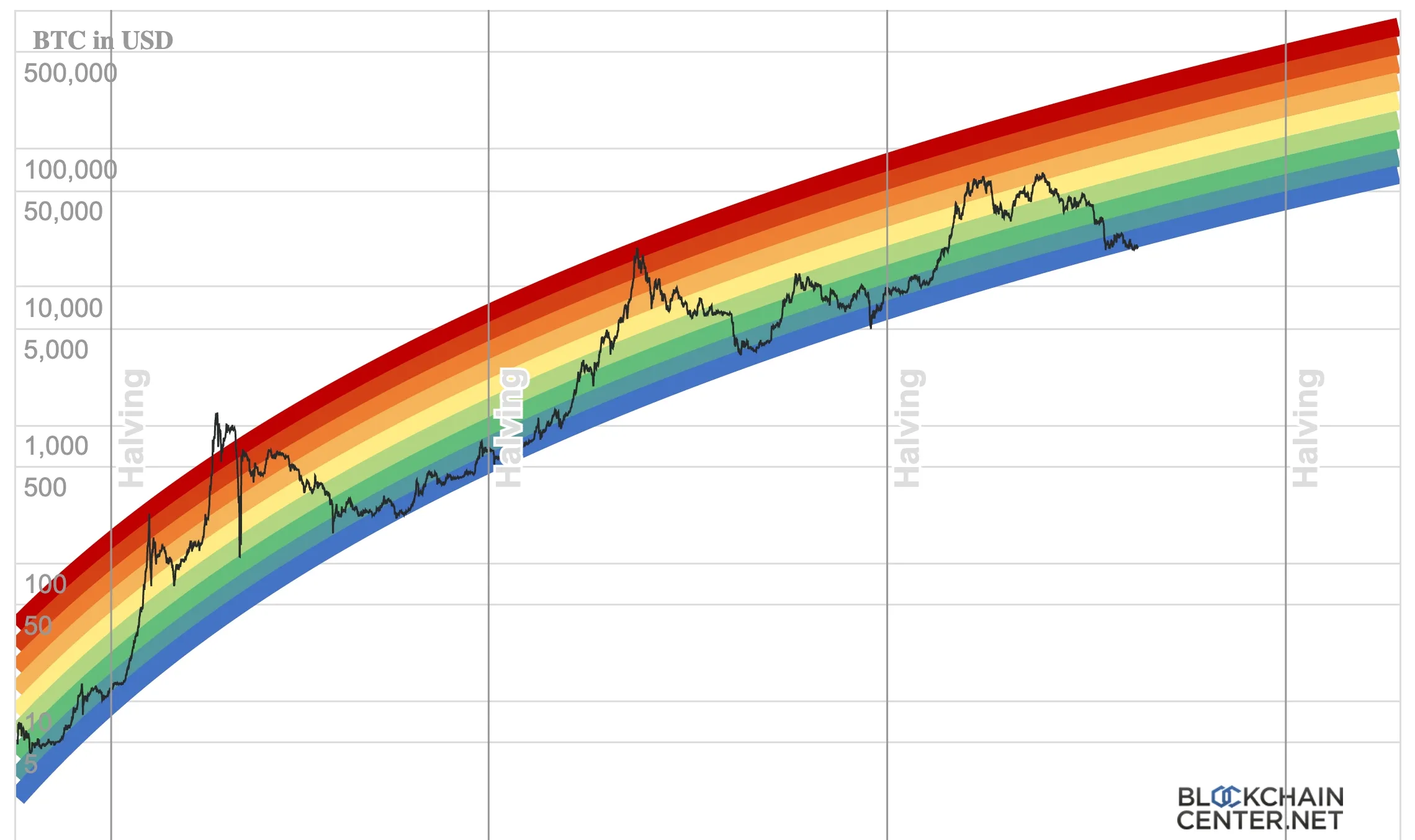

- Halving Event Impact: The April 2024 halving reduced new Bitcoin supply, potentially creating a significant supply-demand imbalance.

Market Sentiment and Expert Predictions

CNBC reports that multiple industry experts are aligning with Lee’s bullish perspective, with several forecasting Bitcoin potentially hitting between $200,000 and $250,000. Cryptoquant suggests favorable economic conditions could propel Bitcoin to at least $145,000 in 2025.

“Bitcoin is no longer just a speculative asset, but a strategic reserve that’s gaining serious institutional credibility.” – Anonymous Financial Analyst

Technological and Economic Catalysts

Technological advancements are playing a crucial role in Bitcoin’s potential growth. Layer 2 solutions like the Lightning Network are enhancing scalability and usability, making Bitcoin more attractive for everyday transactions.

Macroeconomic factors are equally compelling. Ongoing inflationary pressures and geopolitical instability position Bitcoin as an increasingly attractive safe-haven asset. The potential for integration into corporate treasury operations further strengthens its long-term value proposition.

Regulatory Landscape

Political support, particularly hints from the incoming Trump administration, suggests a potentially more favorable regulatory environment. This could significantly boost investor confidence and reduce regulatory uncertainty.

Potential Challenges

Despite the overwhelmingly positive outlook, analysts caution about potential risks:

- Regulatory challenges

- Macroeconomic uncertainties

- Market volatility

- Potential unexpected global economic shifts

Investment Strategies

Experts recommend a measured approach:

- Dollar-cost averaging

- Diversified cryptocurrency portfolio

- Long-term investment perspective

- Continuous market research

The Global Perspective

Interestingly, the trend of nations considering Bitcoin as a strategic reserve asset could further reduce circulating supply and potentially drive prices higher. This global institutional interest represents a significant shift from Bitcoin’s early days as a niche digital currency.

Conclusion

While the $250,000 prediction is exciting, investors should approach with cautious optimism. The cryptocurrency market remains inherently volatile, and while the signs are promising, no prediction is guaranteed.

The journey to $250,000 will be fascinating to watch, with technological innovation, institutional adoption, and global economic dynamics playing pivotal roles.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct thorough personal research and consult with a financial professional before making investment decisions.

Leave a Comment