Bitcoin’s Shocking Surge: What You Need to Know Right Now!

In a landmark moment for the cryptocurrency world, Bitcoin has shattered expectations, rocketing to an unprecedented $100,000 per coin and sending shockwaves through global financial markets. This extraordinary surge represents a 119% increase in 2024, marking a transformative period for digital currencies that has captured the attention of investors, analysts, and economic experts worldwide.

The dramatic rise can be attributed to a complex interplay of factors that have converged to create a perfect storm for Bitcoin’s unprecedented growth. Key catalysts include:

- The recent presidential election of Donald Trump

- Increased institutional investment

- Growing acceptance as an inflation hedge

- Regulatory shifts creating a more favorable environment

Market analysts are buzzing with excitement, noting that Bitcoin’s market capitalization has now reached a staggering $1.3 trillion, representing nearly half of the total $2.6 trillion cryptocurrency market. This milestone isn’t just a number – it’s a testament to the growing legitimacy of digital currencies in the global financial ecosystem.

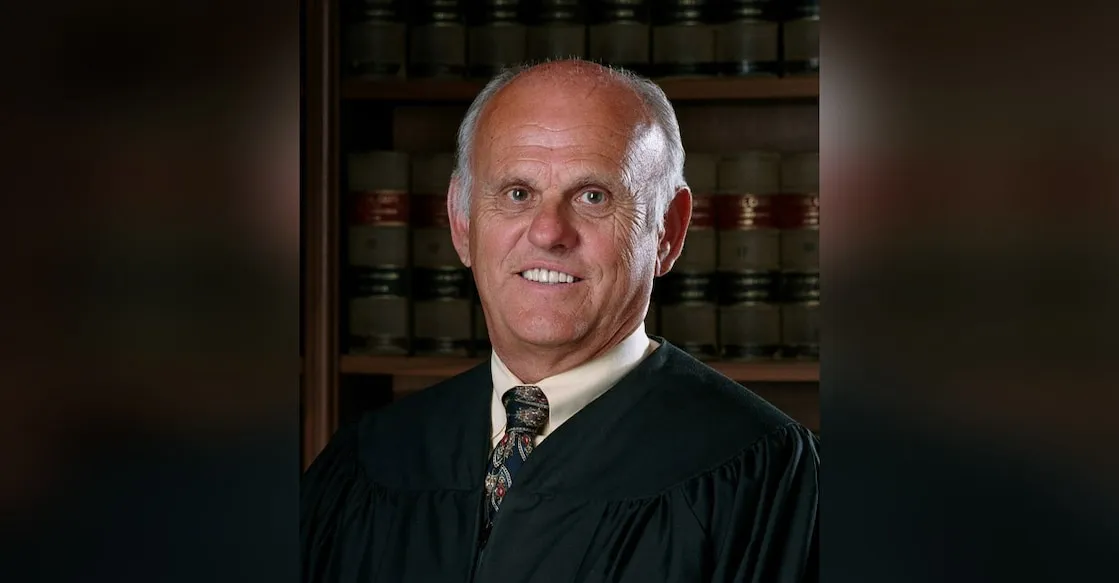

The recent approval of Bitcoin exchange-traded funds (ETFs) by the SEC has been a game-changer. BlackRock’s Bitcoin ETF has emerged as a standout success, accumulating over $50 billion in assets within just one year of its launch. This development has made Bitcoin more accessible to traditional investors who previously viewed cryptocurrency with skepticism.

“We’re witnessing a fundamental shift in how investors perceive Bitcoin,” says financial expert Maria Rodriguez. “What was once considered a fringe investment is now becoming a mainstream financial asset.”

The upcoming Bitcoin “halving” event in 2025 is generating additional excitement. This periodic reduction in new Bitcoin supply is expected to potentially drive prices even higher, with some bold predictions suggesting Bitcoin could reach $250,000 by the end of 2025.

However, the journey isn’t without challenges. Critics continue to raise concerns about:

- Bitcoin’s notorious price volatility

- Potential use in illicit activities

- Long-term sustainability of its current growth trajectory

Institutional investors are taking notice, with many viewing Bitcoin as a critical hedge against inflation. The U.S. government is even exploring the possibility of establishing a strategic Bitcoin reserve, a move that would represent an unprecedented level of official recognition for the cryptocurrency.

The broader cryptocurrency market is experiencing a renaissance, with renewed interest from both individual and institutional investors. This surge isn’t just about Bitcoin – it’s indicative of a larger shift in how we understand and interact with digital assets.

As we look to the future, the cryptocurrency landscape continues to evolve. While the current momentum is promising, experts advise cautious optimism. The market remains unpredictable, and investors are reminded to approach cryptocurrency investments with careful research and risk management.

Key Takeaways:

– Bitcoin has reached $100,000 per coin

– 119% increase in value during 2024

– Institutional investment and ETF approvals driving growth

– Potential to reach $250,000 by 2025

– Ongoing debates about regulation and long-term viability

Disclaimer: Cryptocurrency investments carry significant risk. Always consult with a financial advisor before making investment decisions.

Leave a Comment