Is Inflation Here to Stay? What Every American Needs to Know

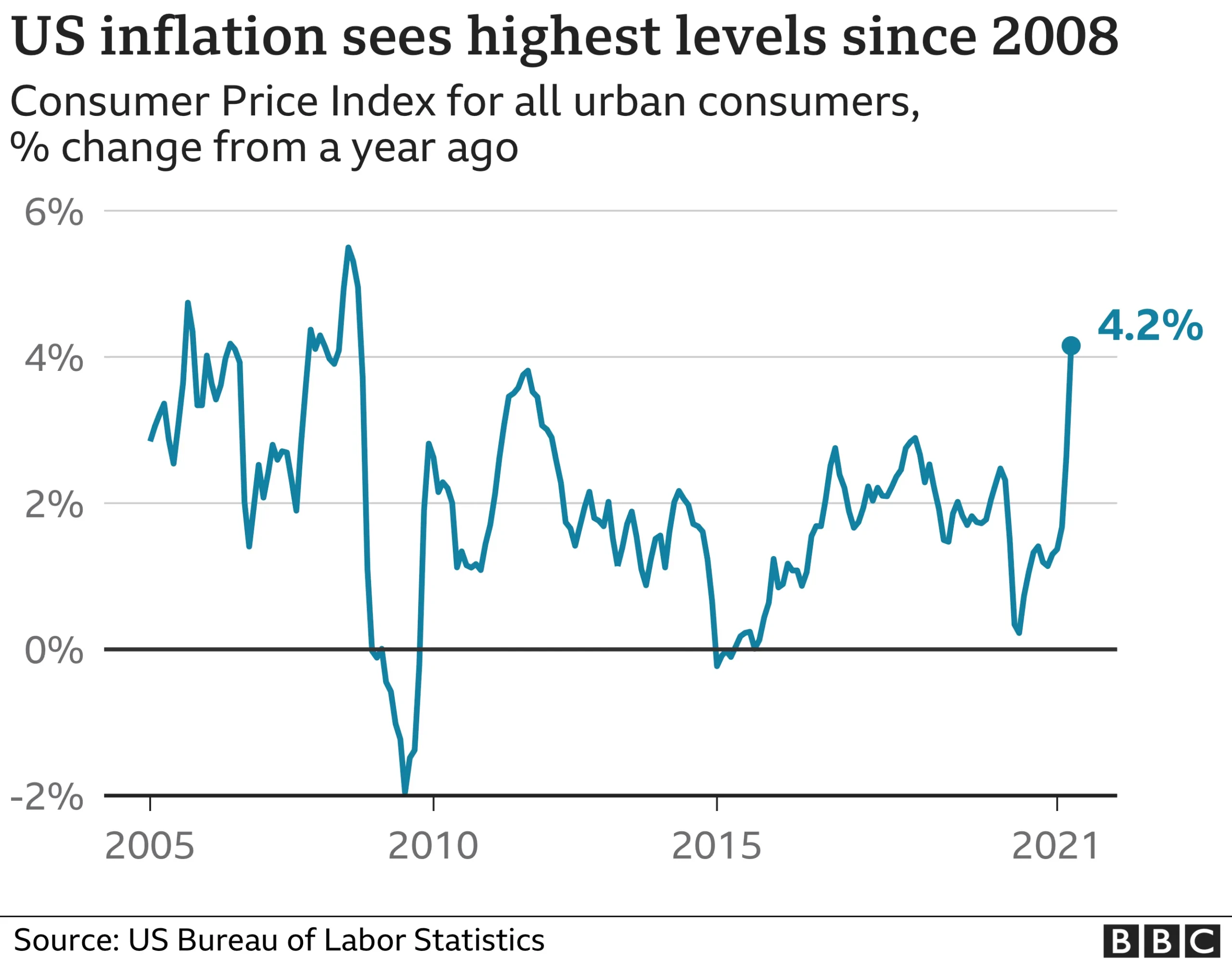

In the complex landscape of the American economy, inflation has emerged as a critical concern that continues to challenge households, businesses, and policymakers alike. As of November 2024, the United States is experiencing an inflation rate of 2.7%, signaling a persistent economic challenge that demands careful attention and understanding.

The Current Economic Landscape

The roots of the current inflationary pressures can be traced back to the unprecedented disruptions caused by the COVID-19 pandemic. Supply chain breakdowns, increased consumer demand, and massive government stimulus packages have created a perfect storm of economic uncertainty. Economists are now grappling with a fundamental question: Is this inflation a temporary phenomenon or a long-term economic reality?

Key Factors Driving Inflation

- Pandemic-Induced Supply Chain Disruptions

- Increased Consumer Spending

- Government Stimulus Measures

- Corporate Pricing Strategies

The Human Cost of Rising Prices

Americans are feeling the pinch in their daily lives. Recent polls reveal that inflation remains the top financial concern for many families. The impact is particularly stark when examining the gap between wage growth and rising prices. Despite modest increases in wages, many workers find their purchasing power significantly eroded.

“Inflation is taxation without legislation” – Milton Friedman

Sectors Most Affected

The inflationary pressure is not uniform across all sectors. Some areas have been hit particularly hard:

- Housing

- Energy

- Food

- Healthcare

Federal Reserve’s Strategic Response

The Federal Reserve has been actively working to combat inflation through strategic interest rate adjustments. Multiple rate hikes are anticipated in 2025, aimed at stabilizing prices and preventing runaway economic instability. However, these measures are a delicate balancing act, requiring precision to avoid triggering a potential recession.

Consumer Behavior Shifts

Interestingly, the pandemic has fundamentally altered consumer spending patterns. There’s been a noticeable shift towards goods over services, which has further complicated supply chain dynamics and contributed to inflationary pressures.

The Global Context

It’s crucial to understand that inflation is not just an American phenomenon. Global supply chain issues, including labor shortages and transportation challenges, continue to exert pressure on prices worldwide.

Political Dimensions

Inflation has become a significant political talking point, with both major political parties using it to critique economic management. This political discourse reflects the deep economic anxieties felt by many Americans.

Looking Ahead: Expert Perspectives

Economists remain divided on the long-term outlook. Some predict a return to more stable prices, while others warn of persistent inflationary trends. The consensus seems to be that careful, strategic management will be crucial in navigating these economic challenges.

Practical Advice for Consumers

- Diversify investments

- Build emergency savings

- Look for ways to reduce personal expenses

- Stay informed about economic trends

Conclusion

While inflation remains a complex and challenging issue, understanding its dynamics can help Americans make more informed financial decisions. The key lies in adaptability, financial literacy, and a nuanced understanding of economic trends.

Disclaimer: Economic conditions are subject to change, and individual financial situations vary.

Note: This article is based on current economic data and expert analysis as of November 2024.

Leave a Comment