Nvidia Stock Soars: Is It Time to Buy or Sell?

In the ever-evolving landscape of technology and investment, Nvidia Corporation has emerged as a true titan, captivating investors and tech enthusiasts alike with its remarkable performance in the artificial intelligence (AI) revolution. The company’s stock has become a focal point of intense market speculation, leaving many wondering about the best investment strategy.

The AI Powerhouse’s Unprecedented Growth

Nvidia has achieved a milestone that few companies have ever accomplished. On June 18, 2024, the company surpassed the $3 trillion market capitalization mark, and by November, it had climbed even higher to over $3.6 trillion. This extraordinary achievement effectively crowned Nvidia as the largest U.S. company, even outpacing tech giant Apple.

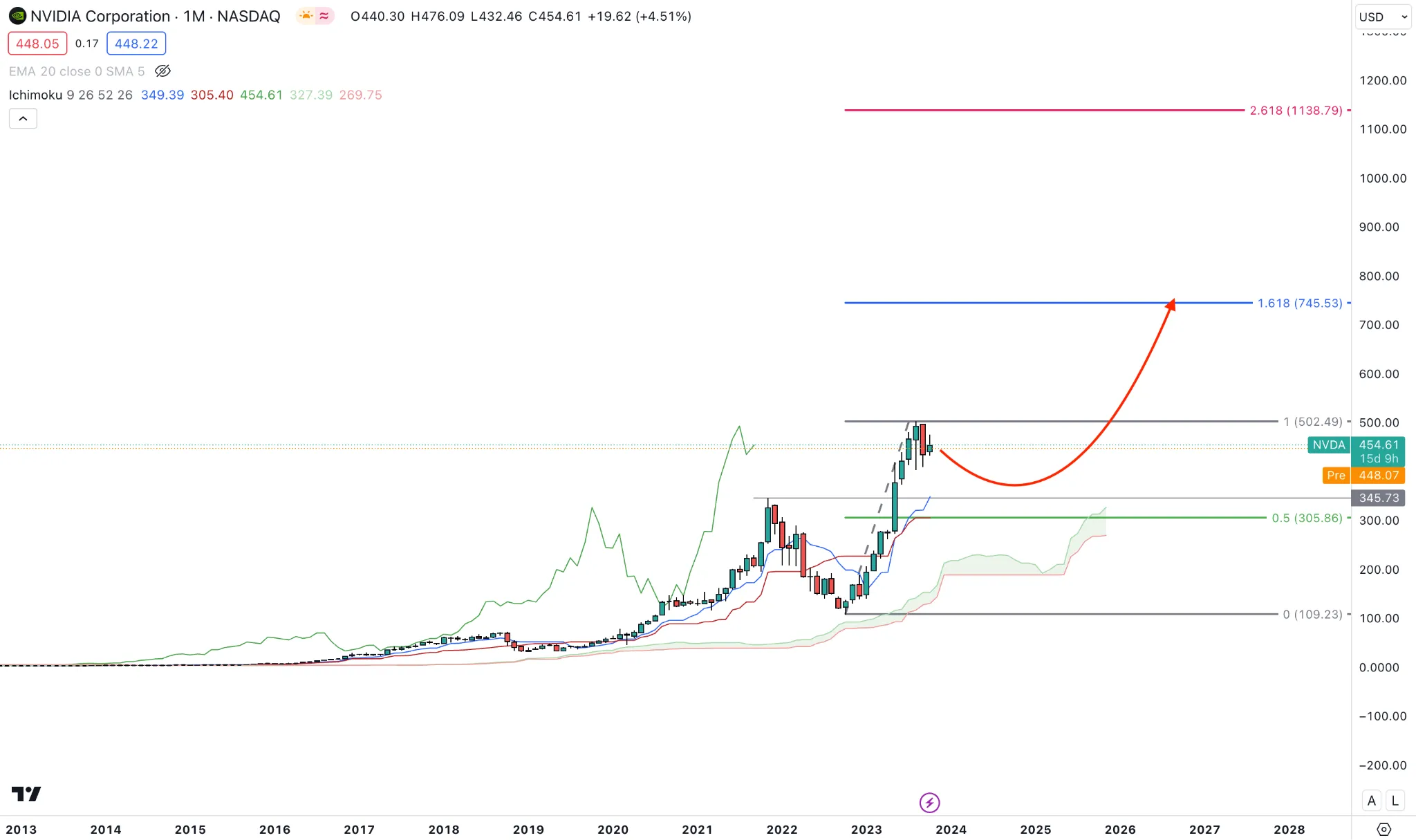

A Closer Look at Stock Performance

The stock’s journey has been nothing short of a rollercoaster. On November 7, 2024, Nvidia reached an all-time high of $148 per share, driven primarily by the insatiable demand for its graphics processing units (GPUs) in AI applications. However, the path hasn’t been entirely smooth, with the stock experiencing a 5% drop following its Q2 2024 earnings report.

The AI Revolution: Nvidia’s Secret Weapon

What’s driving this remarkable growth? The answer lies in the generative AI market. Nvidia’s GPUs have become essential for AI workloads, with the company reporting a staggering 152% year-over-year revenue increase in Q2 2024. The data center business now accounts for nearly 87% of its revenue, generating a record quarterly revenue of $26.3 billion.

Market Analysts’ Perspective

The investment community appears overwhelmingly optimistic about Nvidia:

- Average Brokerage Recommendation (ABR): 1.25 (between Strong Buy and Buy)

- 84.1% of brokerage firms recommend a Strong Buy

- Zacks Consensus Estimate for earnings has increased by 0.4% in the past month

“Nvidia is not just a stock; it’s a testament to the transformative power of AI technology.” – Anonymous Tech Analyst

Potential Challenges and Competitive Landscape

Despite its dominance, Nvidia faces several challenges:

- National security restrictions on chip sales to certain countries

- Increasing competition from tech giants like AMD and Intel

- Potential market saturation in the semiconductor industry

Future Growth Projections

The AI industry is projected to grow at a compound annual growth rate of 42% over the next decade. The generative AI market could potentially reach $1.3 trillion by 2032, presenting a massive opportunity for Nvidia.

Investment Considerations

For potential investors, the decision to buy or sell Nvidia stock requires careful consideration:

-

Pros:

- Dominant position in AI GPU market

- Strong financial performance

- Continued innovation with upcoming Blackwell architecture GPUs

-

Cons:

- High valuation

- Potential market volatility

- Increasing competition

The Stock Split Strategy

On June 7, 2024, Nvidia implemented a 10-for-1 stock split, making shares more accessible to investors and employees. The adjusted trading price settled around $120, further democratizing investment opportunities.

Conclusion: A Balanced Approach

While Nvidia’s performance is impressive, investors should approach with a balanced perspective. The company’s long-term growth trajectory looks promising, but individual investment decisions should align with personal financial goals and risk tolerance.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.

Leave a Comment