NVIDIA Stock Soars: Is It Time to Buy or Sell?

In the rapidly evolving world of technology and artificial intelligence, NVIDIA Corporation (NVDA) has emerged as a standout performer that has captured the attention of investors, analysts, and tech enthusiasts alike. The company’s remarkable journey has been nothing short of extraordinary, with its stock price experiencing unprecedented growth that has reshaped the investment landscape.

The Meteoric Rise of NVIDIA

Over the past three years, NVIDIA has achieved something truly remarkable. The company has created more value than the combined market capitalization of 250 companies in the S&P 500, totaling approximately $3 trillion. This incredible achievement is not just a number, but a testament to the company’s strategic positioning in the AI and semiconductor markets.

Key Performance Highlights

- Stock Performance: NVIDIA’s stock recently surged by 8% in a single trading session

- Market Dominance: Over 48 out of 62 analysts rate the stock as a “Strong Buy”

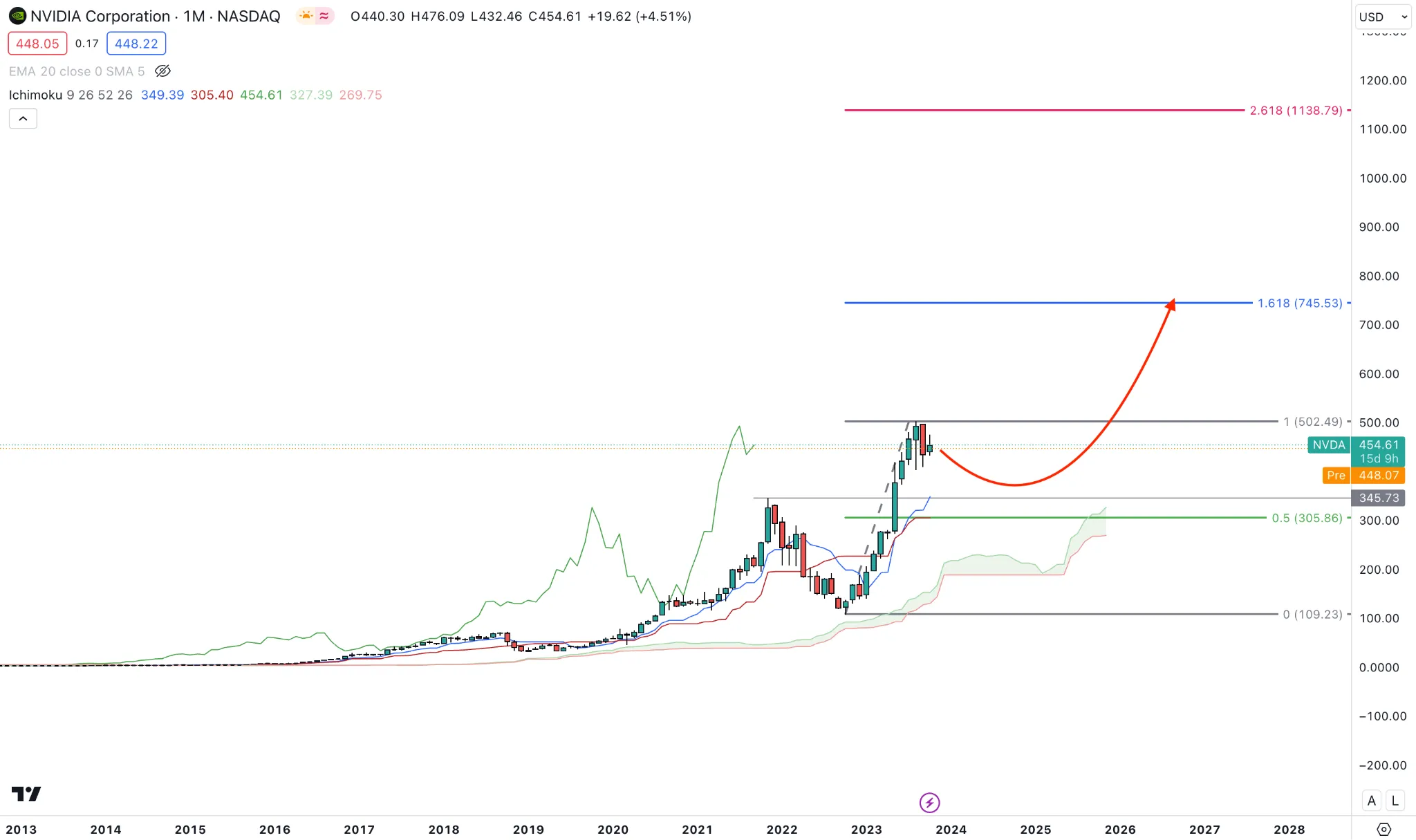

- Historical Growth: Stock price increased from $13 to around $140 since early 2021

The AI Advantage

CEO Jensen Huang has been vocal about the company’s strong market position. During a recent conference, he highlighted the high demand for NVIDIA’s products, signaling robust future growth potential. The company’s competitive edge lies not just in hardware, but in its comprehensive software ecosystem.

“Our software stack, including CUDA and TensorRT, creates a competitive moat that makes it challenging for companies to switch platforms,” Huang emphasized.

Upcoming Technological Innovations

NVIDIA is preparing to launch its next-generation Blackwell processors, with manufacturing ramping up and significant customer demand anticipated. This strategic move could further solidify the company’s position in the AI technology market.

Market Dynamics and Challenges

While the outlook appears promising, investors must consider potential challenges:

- Increasing competition from AMD and Intel

- Potential market volatility

- Uncertainty in long-term revenue sustainability

The AI industry is currently experiencing a “FOMO” (Fear of Missing Out) phase, where companies feel pressured to invest in AI technologies. This dynamic could lead to fluctuating demand for NVIDIA’s products.

Regulatory and Economic Considerations

Recent developments suggest potential market expansion opportunities:

- Possible lifting of semiconductor sales restrictions to Saudi Arabia

- Federal Reserve interest rate cuts potentially reducing financing costs for data center builders

Stock Market Milestone

A significant upcoming event is NVIDIA’s inclusion in the Dow Jones Industrial Average, replacing Intel. This move could enhance the company’s visibility and attract more institutional investors.

Investment Strategy Recommendations

Analysts provide a range of perspectives on NVIDIA’s stock:

- Bullish Outlook: Potential stock price targets reaching up to $300

- Cautious Approach: Recommended careful evaluation of short-term volatility

- Long-term Potential: Strong software ecosystem and AI market leadership

The Verdict: Buy, Hold, or Sell?

While no definitive answer exists, investors should consider:

– Personal investment goals

– Risk tolerance

– Overall portfolio diversification

Final Thoughts

NVIDIA represents a compelling investment opportunity in the AI and semiconductor space. However, prudent investors should conduct thorough research and potentially consult financial advisors before making investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Market conditions can change rapidly, and past performance does not guarantee future results.

Leave a Comment